In warehouses, goods are handled either manually or by automated machines. Manual handling involves using various tools and equipment to lift heavy or sometimes out of gauge cargo.

Modern warehouses have a vast array of equipment, most of which are used in daily operations to receive, store, dispatch, and move goods within the warehouse.

Such equipment, known as warehouse Material Handling Equipment or simply MHE, help reduce manual effort while safely and efficiently executing various tasks.

Different types of material handling equipment are used to handle different kinds of cargo, such as bulk cargo or individual cartons. Bulk cargo could be solid, liquid, or gaseous.

Material handling includes the tasks that have to be carried out to move goods from one point to another – be it inside a warehouse or factory or between locations separated by a vast distance.

Material handling equipment is used throughout the entire chain of physical movement or storage of goods.

It is used in the movement of raw materials and during the process of production.

MHE is used to handle finished goods, during storage of these goods, and their transport and distribution. In short, MHE is required in all of the physical aspects of a supply chain.

Efficient handling of material using suitable material handling equipment throughout the supply chain is necessary to keep costs down and maintain a high quality of service.

The right MHE helps to prevent damage to goods while assuring the safety of the personnel handling them. They provide a continuous movement or flow of goods.

MHE eliminates unnecessary movements and minimises the required ones to the optimum, thereby helping execute the various functions on time.

Types Of MHE

Depending on the type of goods handled, some material handling equipment, such as certain types of conveyor belts or rollers, make use of friction or gravitational force to move the goods.

Typically, material handling equipment includes the following:

- Manual pallet trolley

- Battery-powered pallet trolley controlled by an operator

- Forklift and Reach truck

- Crane

- Lift

- Conveyor system

- Robotics

- Protective covers and safety equipment

Manual Pallet Trolley

Hand-operated pallet trolleys are wheeled, with a sturdy, strong fork in front. They are designed ergonomically to lift pallets from underneath, move, and lower them as required using a pumping action of the handle. Such pallet trucks are used to move pallets between short distances within a warehouse.

Battery-Powered Pallet Trolley

A battery-powered pallet trolley on the other hand uses electric power from batteries installed on the trolley to move, lift, and lower pallets. Some of them have a small platform for the operator to stand on while operating the MHE.

Both the hand-operated as well as the battery-powered trolleys typically carry up to 3000 kilograms load.

Forklift and Reach Truck

Forklifts or lift trucks are powered industrial trucks used to lift, move, and lower loads within a warehouse or over short distances. Forklifts can carry loads up to 50000 kilograms. The heavy-duty ones are used to move cargo containers, etc.

Similar to the forklift, a reach truck is much smaller and therefore more easily manoeuvrable. It can move quickly down narrow aisles to pick up or set down a load. Double-reach trucks that use a telescopic mechanism can go two pallets deep into a rack to pick up or set down a load.

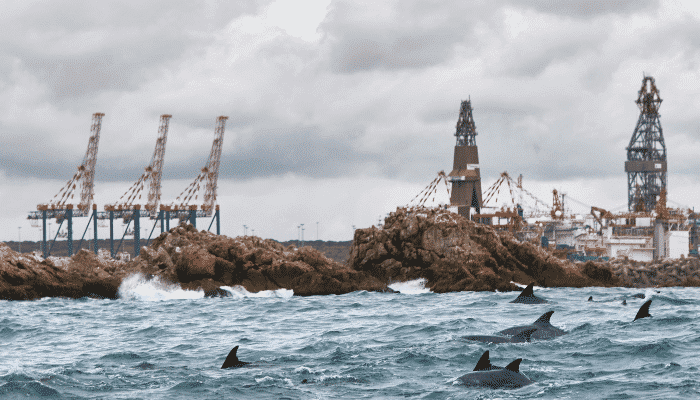

Crane

The two most common types of cranes used in warehouses are the bridge crane and the jib crane.

Bridge Cranes

Bridge cranes are generally used to lift and move large, heavy objects in manufacturing and assemblies. It consists of a hoist on a bridge that carries on two rails that usually run the length of the warehouse. In addition, bridge cranes are used to access goods that are kept below the bridge.

Jib Cranes

Jib cranes are hoists that are mounted on a boom or a jib that is usually fixed to a wall or a sturdy, vertical post. Its access area is limited as the hoist moves only along the length of the boom.

Lift

Lifts are small platforms that can be operated manually or using a motor. These are used to move goods vertically from the floor to a higher level or vice versa, where it is received on a pallet trolley for further positioning.

Conveyor System

This is another type of equipment that is used to move goods along a metal or rubberised belt. Conveyor systems typically shift goods horizontally between fixed positions inside a warehouse or an assembly unit.

However, some systems use gravity or friction to move it at downward or upward angles. For example, belt conveyors and roller conveyors are commonly used in warehouses.

Robotics

Robots or machines that perform some of the tasks performed by humans are common these days. They are most useful in doing repetitive tasks or work that have to be carried out under hazardous conditions.

Robots can be programmed to do a job precisely and safely. They are instrumental in the handling and warehousing of dangerous chemicals or bio-hazardous materials.

Protective Covers and Safety Equipment

Some goods require protection from natural elements such as rain or sunlight, especially during their transport. The easiest and the most common method to protect such items is to keep them covered. Heavy-duty sheets made of nylon, plastic, or tarpaulin are normally used for this purpose.

Personal Protective Equipment While Handling Goods

MHE should be operated only by well-trained staff. To protect the operator from injury or accidents, Personal Protective Equipment (PPE) must be used. PPE includes items such as helmets or hard hats, protective clothing, masks, goggles, gloves, etc. They provide protection from flying objects, heat, electricity, chemicals, or particulate matter.

Using the appropriate PPE and following the prescribed safety procedures is key to preventing accidents.

With the current trend of standardised packaging and packing, the equipment used to handle goods also needs to be standardised as far as possible. Storage equipment worldwide such as racks, shelves, and pallets, are usually of standard sizes.

The most common equipment used to store and transport goods as a unit is the pallet. Goods can be stacked or stored efficiently, neatly, and safely on pallets. As a result, it is easy for buyers and sellers in different parts of the world to handle incoming and outgoing cargo using standard MHE and storage equipment.

Source: Marine Insight

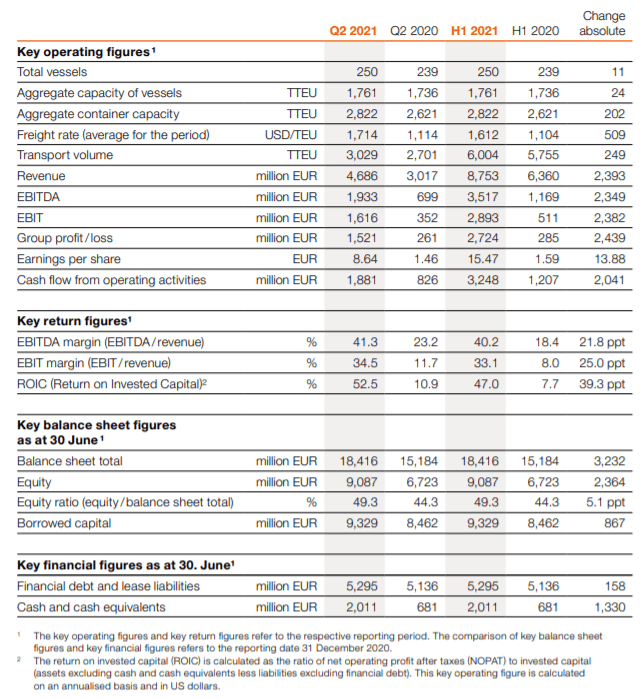

The German carrier has announced impressive increases in all key financial figures in the first six months of 2021, with its revenues climbing to US$10.6 billion (+37.6%), earnings before interest, taxes, depreciation, and amortization (EBITDA) tripling to US$4.2 billion, EBIT rising to US$3.5 billion, which is approximately 5.5 times higher than EBIT of 2020 H1 and the group profit growing to US$3.3 billion, which is more than 9.5 times increased compared with the company’s profit during the first half of 2020.

The German carrier has announced impressive increases in all key financial figures in the first six months of 2021, with its revenues climbing to US$10.6 billion (+37.6%), earnings before interest, taxes, depreciation, and amortization (EBITDA) tripling to US$4.2 billion, EBIT rising to US$3.5 billion, which is approximately 5.5 times higher than EBIT of 2020 H1 and the group profit growing to US$3.3 billion, which is more than 9.5 times increased compared with the company’s profit during the first half of 2020.

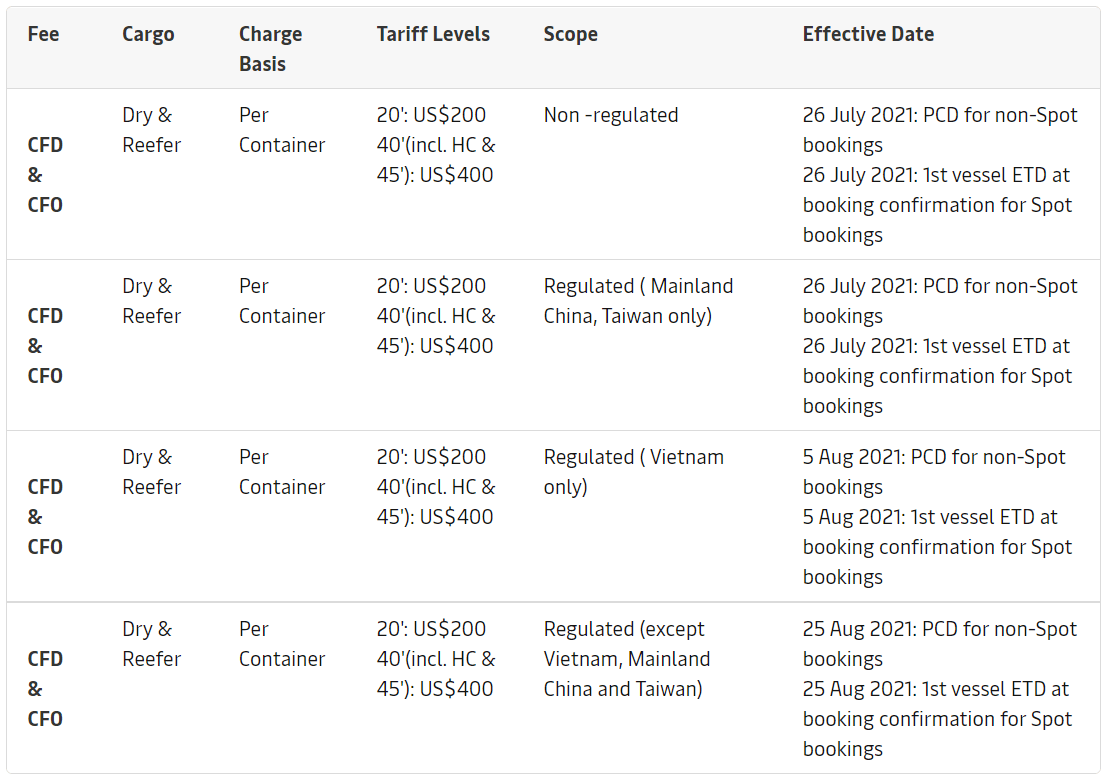

The German line has already implemented since 9 August a general rate increase (GRI) of US$500 per container from China, Hong Kong, Japan, Macau, Mongolia, South Korea, Taiwan, East Russia, Indonesia, Cambodia, Laos, Myanmar, Thailand, Vietnam, Malaysia, Philippines, Singapore and Brunei to the ports in Brazil, Argentina, Paraguay and Uruguay.

The German line has already implemented since 9 August a general rate increase (GRI) of US$500 per container from China, Hong Kong, Japan, Macau, Mongolia, South Korea, Taiwan, East Russia, Indonesia, Cambodia, Laos, Myanmar, Thailand, Vietnam, Malaysia, Philippines, Singapore and Brunei to the ports in Brazil, Argentina, Paraguay and Uruguay.