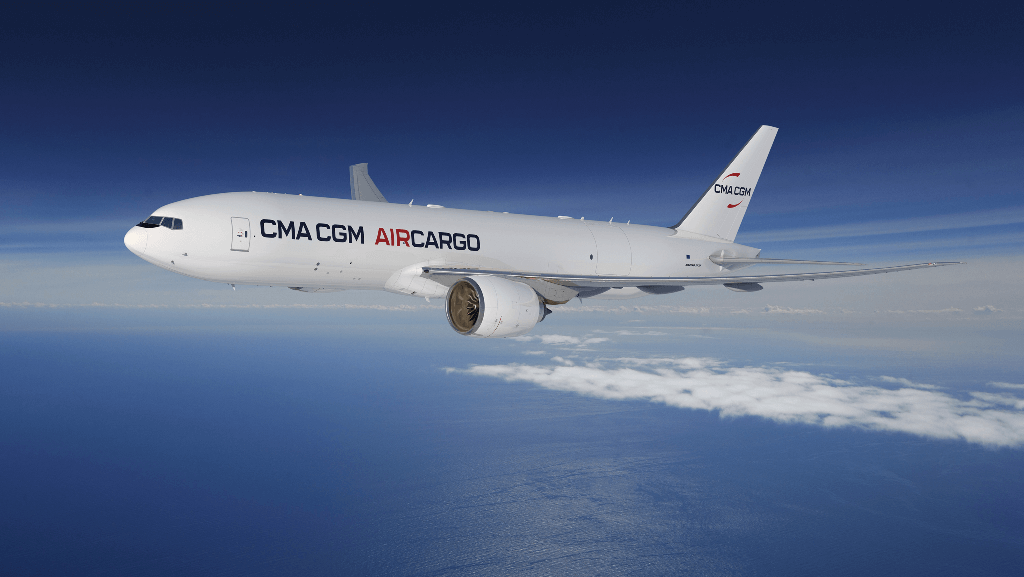

CMA CGM has spent some $753.3m in prepayments on its aircraft orderbook, up from $723.2m at the end of 2021, following its recent order for two 777 freighters, set to deliver in 2024. Meanwhile, the first of its previous order for two 777Fs joined the fleet on 31 May, with the second “in the process of being delivered”.

CMA CGM has spent some $753.3m in prepayments on its aircraft orderbook, up from $723.2m at the end of 2021, following its recent order for two 777 freighters, set to deliver in 2024. Meanwhile, the first of its previous order for two 777Fs joined the fleet on 31 May, with the second “in the process of being delivered”.

However, there was little other new information on air cargo in CMA CGM’s 39-page financial results for Q1. In what will surely change, CMA CGM does not currently separate out its air cargo results, instead lumping them in with ‘Other activities’ which “mainly” include port terminals and air cargo.

Nevertheless, ‘Other Activities’ saw revenue grow to $384m, up from $166.6m a year earlier in the first quarter. Ebitda grew 120% to $84.2m, while ebit jumped an impressive 702% to $35.3m, presumably accounting for the growth in air cargo.

Aside from those details, the group reiterated its recently announced plans on aircraft orders (four A350Fs joining between 2025 and 2026, giving it three aircraft types in its 12-strong future fleet); and agreement with Air France-KLM, which will see CMA Group head Rodolphe Saadé join the airline group’s board. CMA is investing some €400m in AF-KLM’s ex-post share capital, giving it 9% of the airline.

Details on the acquisition of Gefco were also similarly scant, although CMA said the purchase would “strengthen its development within Ceva Logistics”. While the European Commission has authorised CMA to acquire Gefco’s capital immediately, to save the company from sanctions being applied under its former owner Russian Railways, the deal still needs to be approved by competition authorities, and only then can Gefco be integrated.

CMA noted that Ceva meanwhile, has recently acquired Imgram Micro’s ecommerce-related business, including Shipwire, a logistics technology platform, for $2.9bn. It also acquired Colis Privé, a last-mile B2C parcel delivery company in France and Europe, revealing the group’s end-to-end strategy.

There was little further detail beyond limited results information, which showed that CMA’s Logistics segment, primarily Ceva’s operations, saw revenue increase 57% to $2.15bn, while ebitda rose 45% to $171.7m, and ebit jumped 162% to $39.4m.

Meanwhile, the whole CMA CGM group’s revenues for the quarter came in at $18.2bn, resulting in ebit of $7.6bn and a profit of $7.2bn.

Source: The LoadStar

Ocean carriers are focusing their transpacific growth on US east coast port services, as the import coastal shift from the west coast continues.

Ocean carriers are focusing their transpacific growth on US east coast port services, as the import coastal shift from the west coast continues.