Schedule reliability is becoming a greater concern for Indian shippers as they scramble to find more vessel space necessary to hit fiscal year-end shipment target goals.

Schedule reliability is becoming a greater concern for Indian shippers as they scramble to find more vessel space necessary to hit fiscal year-end shipment target goals.

Hapag-Lloyd’s East Africa-India Service (EA2) is skipping Jawaharlal Nehru Port Trust (Nhava Sheva) and Mundra on its current voyage, the two port calls in India. Nhava Sheva and Mundra together handle the chunk of Indian containerised trade.

“MV Emirates Asante V02205N/V02210S will omit Nhava Sheva and Mundra, India, and imports will be discharged in Jebel Ali, UAE, for further connection to their final port of delivery,” the German carrier said in a customer advisory.

Hapag-Lloyd is expected to announce similar changes for further EA2 sailings.

The Indamex 2 (IN2) Service between India and US East Coast – a consortium arrangement between Hapag-Lloyd and CMA CGM – is due to omitting New York on its seven sailings scheduled between March and April, in addition to downsizing calls to Port Qasim (Pakistan) to biweekly from weekly on six westbound voyages.

As a result, IN2 now has the following port rotation: Port Qasim (biweekly), Mundra, Nhava Sheva, Norfolk, Savannah and Port Qasim.

The rotation changes run from sailing APL California, which was to depart from Port Qasim on 6 March.

Hapag-Lloyd said the rotation modifications would help to overcome the continuing congestion on the US East Coast.

On the India-Europe trade lane, EPIC Service will skip Hazira Port, one of its three port calls in India, between March and April. Hazira is critical to North India hinterland cargo connectivity.

The change begins with the vessel Sofia Express (voyage 2309W) and runs until the vessel Tsingtao Express (voyage 2316W) – with departures scheduled from JNPT on 5 March and 23 April, respectively, according to a customer advisory issued by Hapag-Lloyd.

Given the port call cancellations, the carrier noted that shippers have options via Mundra (India) for westbound shipments and via Jebel Ali (UAE) for eastbound cargo.

“These changes will be in place during Q1 2022 to help improve the service’s schedule reliability,” noted the company.

An array of other service rearrangements are also on the cards for Indian exporters and importers. For example, China-India Service

The CIX service will have no eastbound sailings from Colombo (Sri Lanka) on 15 April and 20 May. Colombo handles the majority of Indian transshipment cargo, especially to/from the southern region.

Additionally, the South East India–Europe Express (IEX) Service, linking to North Europe and the Mediterranean, has already announced weeks of voyage cancellations for India’s Visakhapatnam Port, from February through May.

Source: Container News

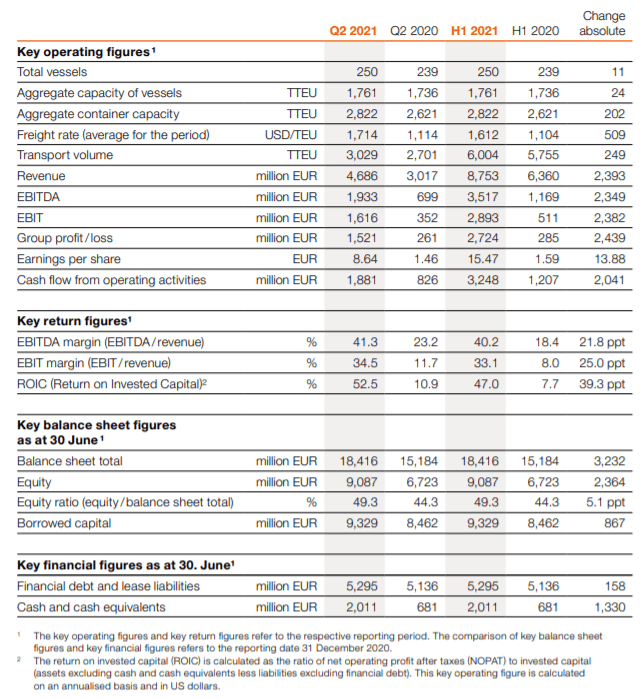

The German carrier has announced impressive increases in all key financial figures in the first six months of 2021, with its revenues climbing to US$10.6 billion (+37.6%), earnings before interest, taxes, depreciation, and amortization (EBITDA) tripling to US$4.2 billion, EBIT rising to US$3.5 billion, which is approximately 5.5 times higher than EBIT of 2020 H1 and the group profit growing to US$3.3 billion, which is more than 9.5 times increased compared with the company’s profit during the first half of 2020.

The German carrier has announced impressive increases in all key financial figures in the first six months of 2021, with its revenues climbing to US$10.6 billion (+37.6%), earnings before interest, taxes, depreciation, and amortization (EBITDA) tripling to US$4.2 billion, EBIT rising to US$3.5 billion, which is approximately 5.5 times higher than EBIT of 2020 H1 and the group profit growing to US$3.3 billion, which is more than 9.5 times increased compared with the company’s profit during the first half of 2020.

The German line has already implemented since 9 August a general rate increase (GRI) of US$500 per container from China, Hong Kong, Japan, Macau, Mongolia, South Korea, Taiwan, East Russia, Indonesia, Cambodia, Laos, Myanmar, Thailand, Vietnam, Malaysia, Philippines, Singapore and Brunei to the ports in Brazil, Argentina, Paraguay and Uruguay.

The German line has already implemented since 9 August a general rate increase (GRI) of US$500 per container from China, Hong Kong, Japan, Macau, Mongolia, South Korea, Taiwan, East Russia, Indonesia, Cambodia, Laos, Myanmar, Thailand, Vietnam, Malaysia, Philippines, Singapore and Brunei to the ports in Brazil, Argentina, Paraguay and Uruguay.