Τaiwanese liner operator Yang Ming Marine Transport has agreed to charter one of its container ships to Maersk Line for a year at nearly US$63 million.

Close

Dear Customers, if you wish to receive a quotation, we kindly ask you to fill in below form. Once the form has been duly filled and submitted, the rates will be quoted to you.

Τaiwanese liner operator Yang Ming Marine Transport has agreed to charter one of its container ships to Maersk Line for a year at nearly US$63 million.

The largest container alliance in the world, 2M Alliance has decided to change the rotation of several services in Europe, due to port congestions and supply chain issues.

In particular, the alliance, which comprises Maersk and MSC, has announced that its Condor/AE7 service will be calling at Wilhelmshaven instead of Felixstowe until the end of the year, due to the ongoing congestion issues at Britain’s major port.

In particular, the alliance, which comprises Maersk and MSC, has announced that its Condor/AE7 service will be calling at Wilhelmshaven instead of Felixstowe until the end of the year, due to the ongoing congestion issues at Britain’s major port.

The first ship that will sail under the updated rotation will be the 15,908TEU MSC New York, voyage NR136W and the last one will be the 11,000TEU Eleonora Maersk voyage 144W.

The import cargo bound for the Port of Felixstowe will be routed via a shuttle service from Antwerp, according to the statement.

Additionally, 2M Alliance said that it will be omitting Antwerp on its Griffin/AE55 service and will have an inducement call at Le Havre for the next five sailings.

“As the situation at Antwerp has not improved, we will be continuing with the temporary port rotation change arrangement for the next few weeks,” note MSC.

Last but not least, 2M Alliance will omit the port of Le Havre at the Lion/AE6 service for the next four sailings, and they will continue to combine the Antwerp call.

Source: Container News

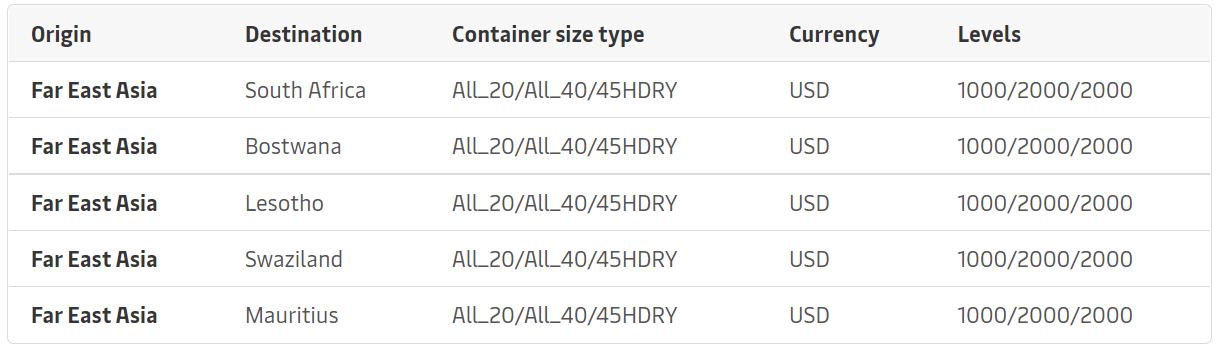

The world’s largest container line, Maersk will apply a new Peak Season Surcharge (PSS) from East Asia to African destinations.

In particular, Maersk will implement a PSS to all 20′, 40′ and 45′ dry cargoes travelling from the Far East to the ports in South Africa, Botswana, Lesotho, Swaziland and Mauritius.

The surcharge will be effective from 1 October for regulated and non-regulated corridors, according to a statement, except of Taiwan, where the PSS will launch on 16 October.

The surcharge will be US$1,000 and US$2,000 per 20′ and per 40′, 45′ containers, respectively, as follows:

Source: Container News

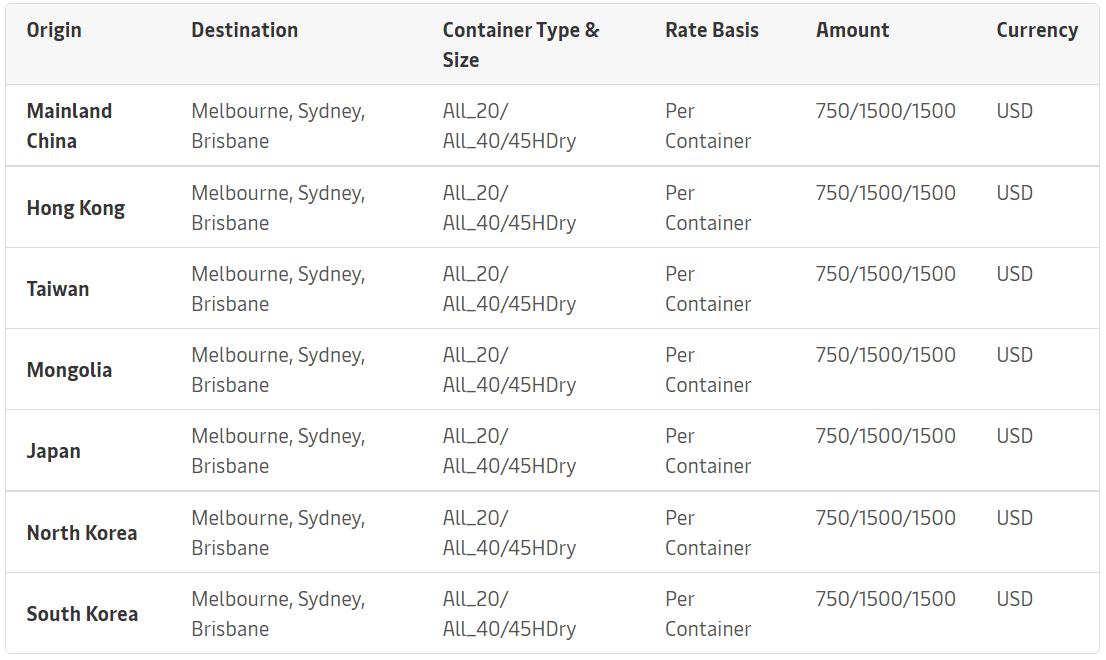

Two of the largest European shipping companies, Maersk and CMA CGM, will introduce new Peak Season Surcharges (PSS) for sailings with destinations to Australia, that will be effective from August and September.

In particular, Maersk will push up its rates for all types of cargo, from Mainland China, Hongkong, Taiwan, Mongolia, Japan, North Korea and South Korea to the Australian ports of Melbourne, Sydney, Brisbane, starting on 16 August, as follows:

Furthermore, CMA CGM will set a PSS of US$1,200 per TEU and US$1,400 per FEU for dry containers, including special equipment, in gauge and out of gauge, from North Europe and Mediterranean ports to Australia and New Zealand.

The surcharge of the French box line will take effect on 10 September and will be valid for less than three months.

Source: Container News

PSA Mumbai has received the inaugural call of Maersk Line’s ME2 service with the arrival of the 10,100TEU vessel, Maersk Gibraltar, on 12 August 2021.

PSA noted that the ME2 marks PSA Mumbai’s eighth weekly call and second Europe service.

PSA noted that the ME2 marks PSA Mumbai’s eighth weekly call and second Europe service.

The first call at PSA Mumbai also marks an upgrade of the ME2 service with vessel capacity doubling to 10,000TEU sized vessels and the following revised port rotation:

PSA Mumbai – Salalah – Jeddah – Suez Canal – Port Said East – Port Tangier Mediterranee– Algeciras – Valencia – Genoa – Port Said East – Suez Canal – Jeddah – Salalah – Mundra – PSA Mumbai.

“We are glad to take our global relationship with PSA one step forward by commemorating our ME2 service at PSA Mumbai, giving us an edge to meet customer satisfaction,” commented Vikas Agarwal, Managing Director Maersk Line South Asia.

“We will continue playing our part to keep India’s maritime trade moving smoothly; whilst worldwide schedule disruptions have resulted in 61% of vessels arriving at PSA Mumbai off schedule during the first seven months of 2021, we have provided 93% berthing on arrival for these, helping carriers get back on schedule,” said Sivakumar Kaliannan, Managing Director of PSA Mumbai.

Source: Container News

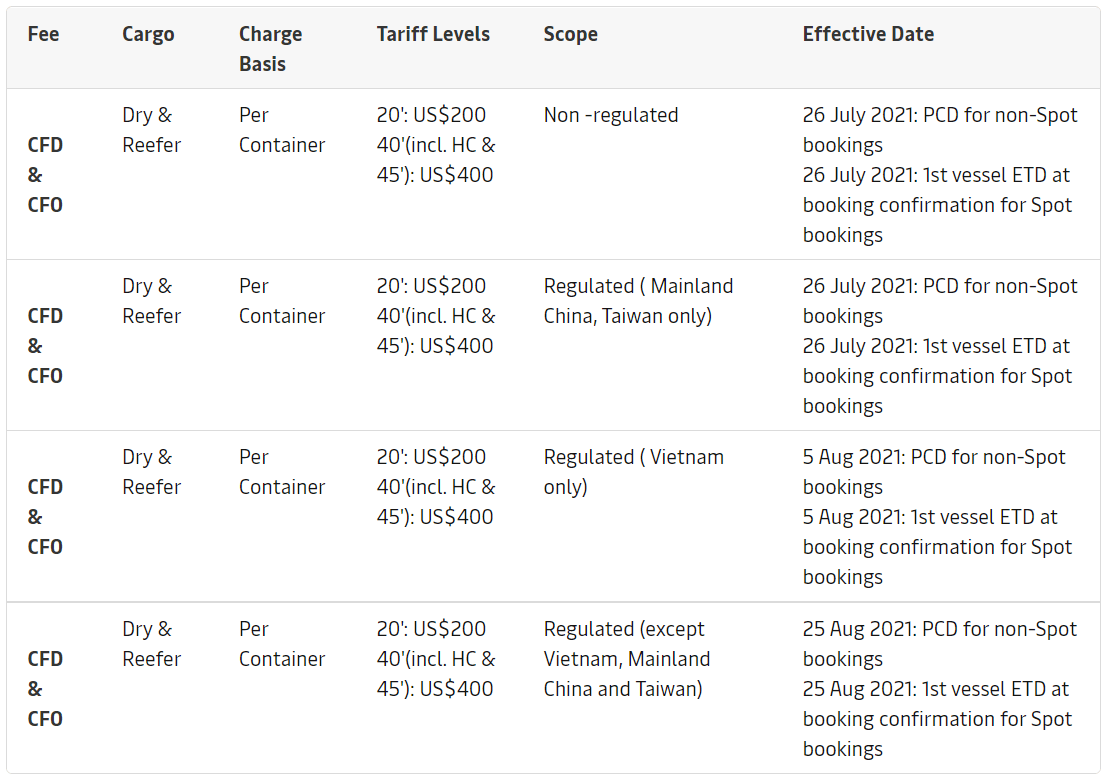

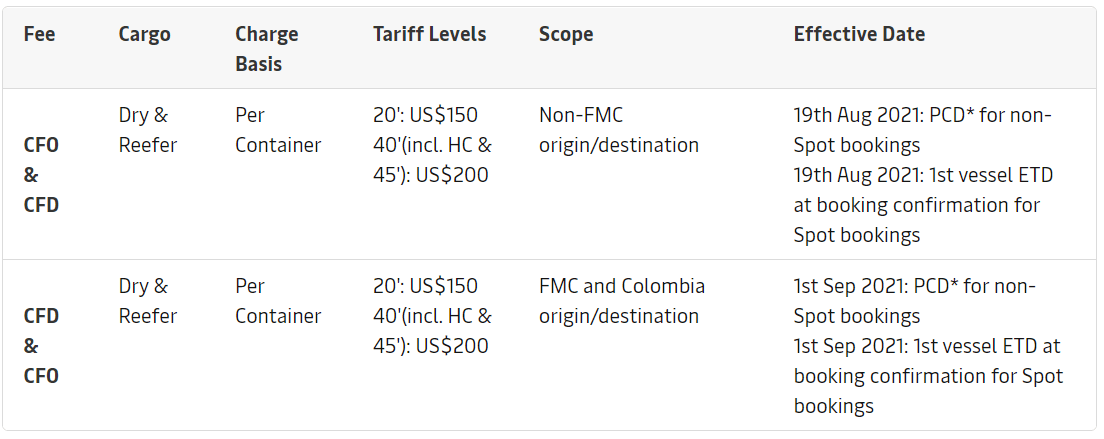

The Danish liner operator Maersk has confirmed the implementation of congestion surcharges in several ports across the world.

In particular, Maersk has announced the following Congestion Fee Destination (CFD) and Congestion Fee Origin (CFO) in the ports of Rades and Tunis in Tunisia for dry and reefer containers.

Furthermore, the Copenhagen-based carrier will apply a congestion fee of US$150 per 20′ and US$200 per 40′, 45′ and high cube (HC) dry and reefer boxes in Paraguay.

Moreover, Maersk will introduce a congestion surcharge of US$175 per container to and from Memphis CY, due to the ongoing congestion in the area as a result of the I-40 Bridge closure at the city of Memphis in Tennesse.

The Inland Peak Season Surcharge – Export (IPE) and Import (IPI) will be applicable from 1 September and to all import and export Store Door (SD) service moving under Maersk provided trucking (MPT), “where Maersk is responsible for securing truck power from CY Memphis.”

Source: Container News

Maersk Line has announced several changes to its services globally, such as blanks sailings, port omissions and route adjustments.

Firstly, the Danish carrier has decided to implement alterations to TP Alaska service, which links Asia and North America.

In particular, Maersk will substitute Seattle for Tacoma as a network change on TP Alaska service in order “to mitigate disruption to product and to alleviate the capacity lost.”

The service has already been using Seattle as a contingency call in the past couple of sailings and the change will be implemented with immediate effect from Jens Maersk 128E/131W.

In addition, the Copenhagen-based container line has announced that the 7,114TEU vessel, Santa Barbara, will be omitting Coega Port in Port Elizabeth in order to “protect her onward schedule and to make her Container Terminal Operation Contract (CTOC) window in Cape Town”.

Consequently, all Coega imports loaded from Durban to Coega will be transferred to the Protea Service and containers will be discharged at Port Elizabeth Container Terminal (PECT). As for the Coega export units, they will be loaded on the Santa Cruz 213S Voyage.

Furthermore, due to delays from Luanda and Walvis Bay, the 8,200TEU Maersk Amazon will not be able to make her CTOC window in Cape Town and will therefore omit this call.

For this reason, there are currently no imports onboard the Maersk Amazon for Cape Town delivery, and all Cape Town exports that were previously booked will be transferred to the Safmarine Chachai 128E, according to a company’s statement.

Last but not least, due to the port congestion and delayed vessel berthing both in Australia and South East Asia, Maersk will also adjust its schedule for the Komodo service as a part of its effort to enable a weekly connection between South East Asia and Australia.

Therefore, the following vessel will have revised arrival in the Malaysian Port of Tanjung Pelepas (MYTPP): Komodo – CMA CGM BELLINI / 133S will slide one position into MYTPP with revised arrival 27 August.

“Voyage numbers will only be changed during the next cycle of sailings,” noted the company.

Source: Container News

Maersk has decided to make changes to the OC1 service due to ongoing delays aiming to reestablish schedule reliability.

The Danish shipping line will be omitting the port of Cartagena – Sociedad Portuaria Region the southbound voyage until further notice.

The first vessel to omit Cartagena southbound is Oluf Maersk voyage 135S on 16 September, while Maersk will still be offering a northbound call, as per the below revised rotation:

The updated OC1 rotation will therefore be as follow: Philadelphia – Charleston – Cartagena* – Panama Canal – Balboa – Tauranga – Sydney – Melbourne – Timaru* – Port Chalmers** – Napier** – Tauranga – Panama Canal – Manzanillo – Cristobal – Cartagena – Philadephia.

*Cartagena and Timaru omission until further notice.

**Alternate omission between Port Chalmers and Napier until further notice.

On the southbound voyage, the company said it will continue to serve Cartagena via rail to Balboa, Panama.

#ContainerNews

Ships involved in two of container shipping’s worst accidents this year met in Felixstowe yesterday.

Ever Given, which blocked the Suez Canal for six days, passed the Maersk Essen which lost 750 boxes in January, heading for its berth at Trinity Terminal some four months late.

The irony of the meeting was not lost on one embattled insurer who photographed the Ever Given as it passed the 13,100 teu Maersk Essen on its approach to the berth.

Crowds that lined the riverbanks on the approach of the 20,124 teu Ever Given came from far and wide to witness its final discharge call before dry-docking.

Journalists mixed with members of the public and cargo stakeholders, including Steve Harris, of the marine and cargo practice Marsh, to see the vessel’s arrival.

It was an “I was there” moment for some, but for those involved in the complex General Average process of the cargo discharged from the vessel, it was a case of relating the mass of paperwork to the physical presence of a ship.

“I wanted to come to see the ship that has caused me so much work over the past four months,” said a senior marine insurer.

For the photographers, Ever Given looked disappointingly light on deck, having already discharged three-quarters of its 12,000 boxes at Rotterdam, but one insurer was happy with that outcome, saying the Dutch were “welcome to the GA issues”.

Source: The Loadstar

A.P. Møller – Mærsk A/S (APMM) reports an unaudited revenue of USD 14.2bn, an underlying EBITDA of USD 5.1bn and an underlying EBIT of USD 4.1bn for Q2 2021. The strong quarterly performance is mainly driven by the continuation of the exceptional market situation with strong rebound in demand causing bottlenecks in the supply chains and equipment shortage. Volumes in Ocean increased by 15% and average freight rates improved 59% in Q2 2021 compared to previous year.

Consequently, given the strong result in Q2 2021 and the exceptional market situation still expected to continue at least until the end of the full-year 2021, the full year guidance for 2021 has been revised upwards with an underlying EBITDA now expected in the range of USD 18-19.5bn (previously USD 13-15bn) and underlying EBIT expected in the range of USD 14-15.5bn (previously USD 9-11bn).

Representation Image – Credits: maersk.com

As a consequence of the higher earnings expectations, and despite increasing net working capital and higher instalments related to higher charter lease liabilities, the free cash flow (FCF) for the full-year 2021 is now expected to be minimum USD 11.5bn (previously minimum USD 7bn), while the cumulative CAPEX guidance for 2021-22 is unchanged of around USD 7bn.

The outlook for the global market demand growth for the full-year 2021 has been revised up to 6-8% from previously 5-7%, primarily still driven by the export volumes out of China to the US.

Earnings in the third quarter are expected to exceed the level for Q2 2021. Trading conditions for the quarters ahead are, however, still subject to a higher than normal volatility due to the temporary nature of current demand patterns, disruptions in the supply chains and equipment shortages.

APMM will publish its Q2 interim result on 6 August 2021.

Press Release

Ho Chi Minh Office: SAV.2 – 02.30, 2nd Floor, The Sun Avenue, 28 Mai Chi Tho St., Thu Duc City, HCM City

Tel: +84-28 3911 9090

Ha Noi Office: Room 1010, C2 Tower, D’Capital, 119 Tran Duy Hung St., Trung Hoa Ward, Cau Giay Dist., Ha Noi City

Tel: +84-24 320 22 030

Hai Phong Office: Room 507 & 508, 5th Floor, Success 1 Building, 03 Le Thanh Tong St., May To Ward, Ngo Quyen Dist., Hai Phong City

Tel: +84-225 883 0451

Da Nang Office: Room 706, 7th Floor, Muong Thanh Luxury Song Han, 115 Nguyen Van Linh St., Nam Duong Ward, Hai Chau Dist., Da Nang City

Tel: +84-236 3633 069

—–

Inquiry: sales@macnels.com.vn

Hours: Mon-Fri:8:00-17:00; Sat: 8:00-12:00