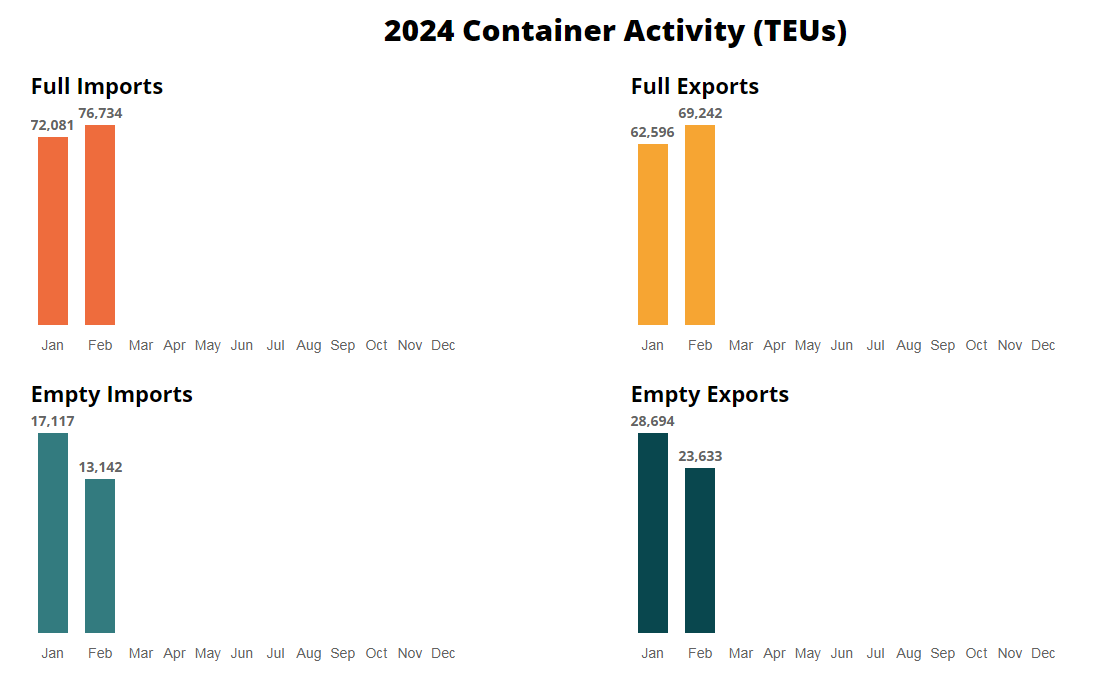

Container volume at the Port of Oakland surged in February, surpassing the volume recorded in the same month last year.

Imports experienced a significant increase for the fourth consecutive month, rising by 32.1% to 76,734 TEUs compared to 58,073 TEUs in February 2023. This growth was fueled by robust consumer spending in Northern California, according to the port’s announcement.

Meanwhile, exports also saw a notable uptick, rising by 24.2% to 69,242 TEUs in February 2024, compared to 55,279 TEUs in February 2023. This marks the third consecutive month of export growth and represents the highest monthly total since May 2022.

Overall, combined full TEUs for the first two months of 2024 have increased by 18.1% compared to the same period in 2023.

“The trends we saw in previous months have continued in February. Consumer demand remains strong in Northern California & Rocky Mountain states region for imports and in Asia for the region’s exports. We believe that cargo volume will continue to modestly grow for the rest of the year, reversing some of the declines we saw in 2022 and 2023,” stated Bryan Brandes, maritime director at Port of Oakland.

In February 2024, the Port of Oakland experienced a 9.8% decrease in empty imports, with 13,142 TEUs passing through its facilities compared to 17,299 TEUs in February 2023.

Similarly, empty exports declined by 7.2%, handling 23,633 TEUs in February 2024, in contrast to 38,014 TEUs in February 2023. This marks the seventh consecutive month of decline and suggests a trend of more containers returning to Asia loaded with US goods.

Source: Container News