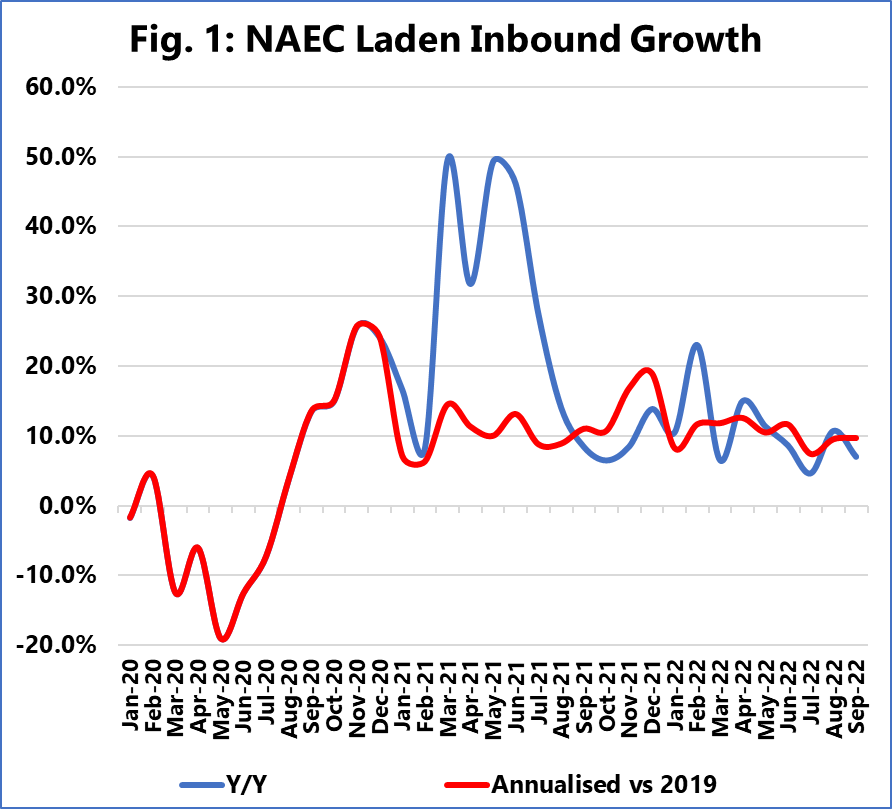

As the traditional peak season of the shipping sector comes to an end, the spot rate declines over the past two weeks are a very clear indicator that the peak season did not really materialise, according to the recent Sea-Intelligence report.

Further to that, the Danish maritime data analysis company noted that there are “dark clouds looming over the horizon” for the Transpacific trade, in part linked to US consumer behaviour.

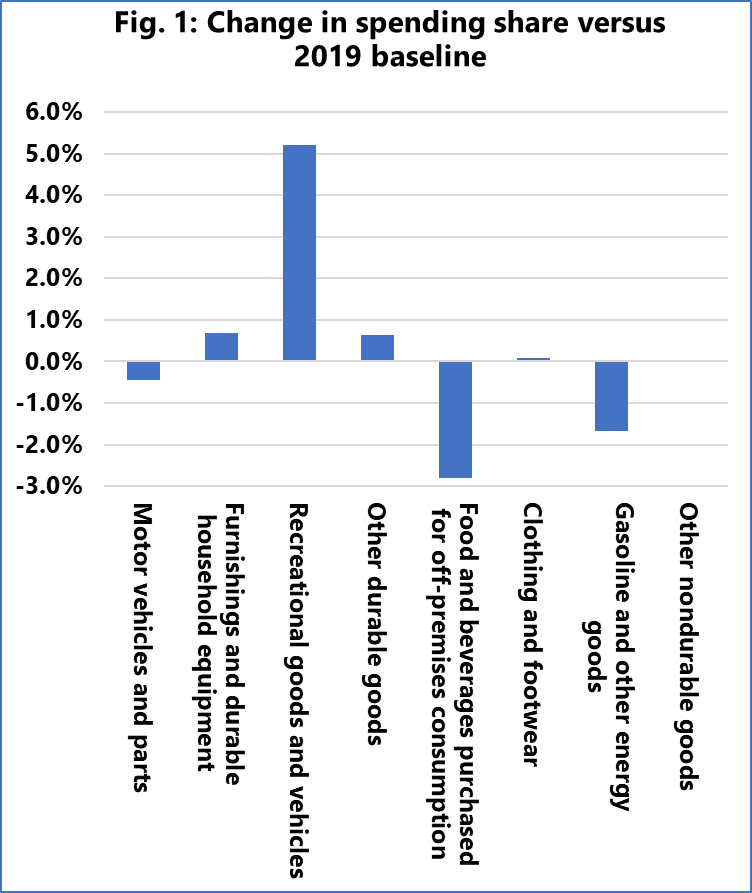

One element is the change in consumer behaviour during the pandemic (from services to goods), which is very likely to change back and have a negative impact on import volumes, according to the report.

“Digging deeper, we see that in recent months, the growth is concentrated on goods which are not predominantly moving in containers,” said Alan Murphy, CEO of Sea-Intelligence.

As shown in the figure, the highest growth is for recreational goods and services, which rose from 12% in 2019 to 17.2% by July 2023. Moreover, the Danish analysts note that the largest growth within this category is exhibited by ‘Video, Audio, Photographic, Information Processing Equipment, and Media’.

The ‘Information Processing Equipment’ is also growing fast mid-2023 with the main driver of strong growth within this category clearly seen to be Computer Software and Accessories; and software is mainly not moving in containers, which means that this strong boost to consumer spending does not benefit container shipping lines.

“Another major growth component on goods spending is the overall ‘Vehicles’ category. New vehicles are indeed growing well, but once again, these are mainly not containerized,” said Murphy.

Source: Container News

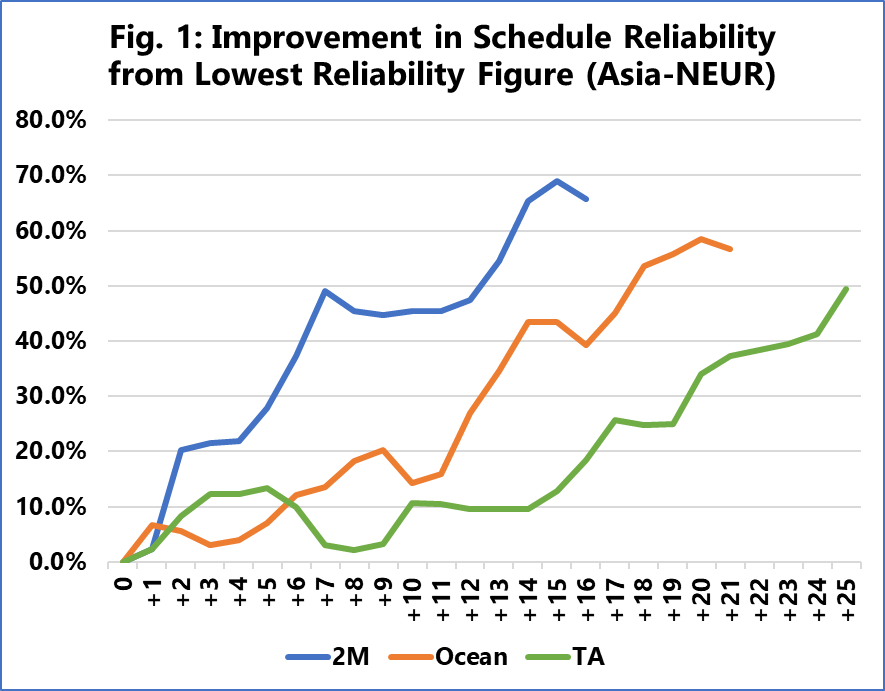

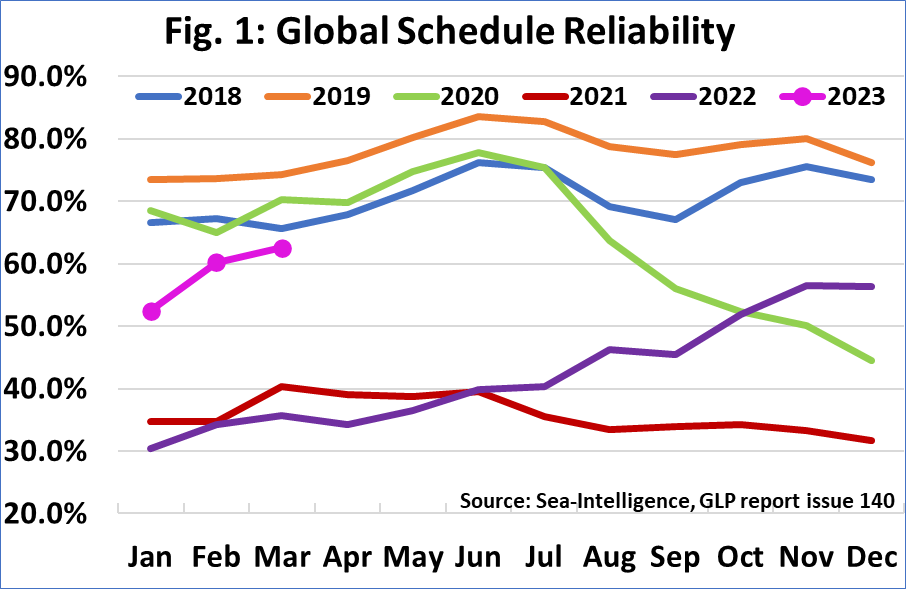

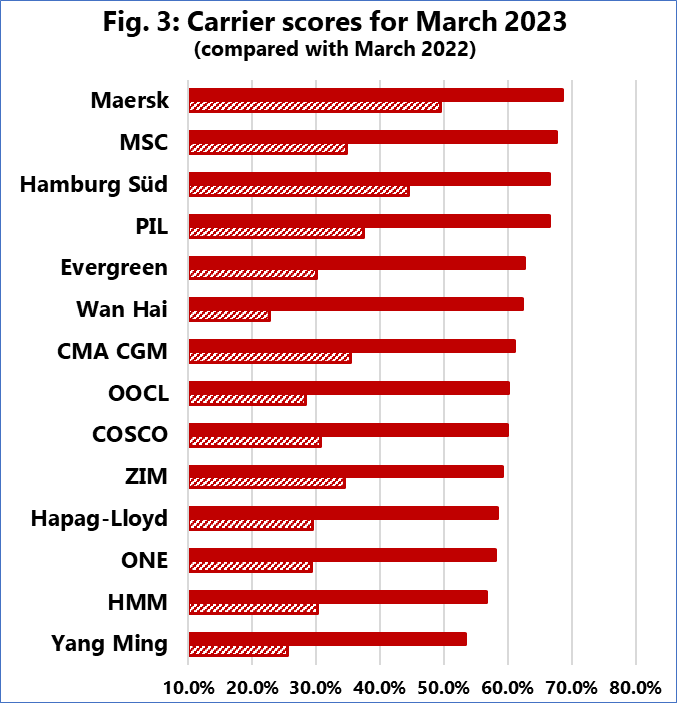

To gauge which of the three container carrier alliances recorded the fastest post-pandemic recovery in schedule reliability, Danish maritime data analysis company Sea-Intelligence pegged their lowest recorded schedule reliability during the pandemic as month “0” and then looked at the change from that baseline in the next months.

To gauge which of the three container carrier alliances recorded the fastest post-pandemic recovery in schedule reliability, Danish maritime data analysis company Sea-Intelligence pegged their lowest recorded schedule reliability during the pandemic as month “0” and then looked at the change from that baseline in the next months.