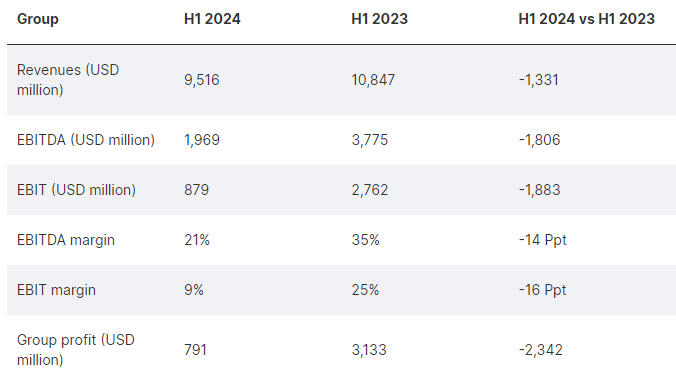

Hapag-Lloyd has reported decreased financial figures in the first half of 2024 with revenues of US$9.5 billion, EBITDA of US$2 billion, EBIT of US$900 million and profit of US$800 million.

“Even though we were unable to match the exceptionally good results of the prior year, we delivered a very good first half of 2024 thanks to strong demand and better spot rates,” commented Rolf Habben Jansen, CEO of Hapag-Lloyd AG.

The German ocean carrier moved 6.1 million TEUs in the first six months of the year, representing a year-on-year growth of 5%. Additionally, Hapag-Lloyd reported an average freight rate of US$1,391/TEU for the first half of 2024.

“We have added several new ships and containers to our fleet. This has helped us to meet the additional capacity requirements resulting from the security situation in the Red Sea and the rerouting of ships around the Cape of Good Hope, thereby keeping supply chains intact. At the same time, we have made more progress in our efforts to decarbonise our fleet as well as in building up our terminal business under the Hanseatic Global Terminals brand. In the second half of the year, we will increasingly focus on continued growth and the high quality of our services,” stated Rolf Habben Jansen.

Given the fact that demand and freight rates have recently exceeded expectations, Hapag-Lloyd’s Executive Board raised its forecast for the current financial year on 9 July 2024. The Group EBITDA is expected to be in the range of US$ 3.5 to 4.6 billion and the Group EBIT to be in the range of US$ 1.3 to 2.4 billion.

“In view of the highly volatile development of freight rates and major geopolitical challenges, this forecast remains subject to a high degree of uncertainty,” noted the company.

Source: Container News