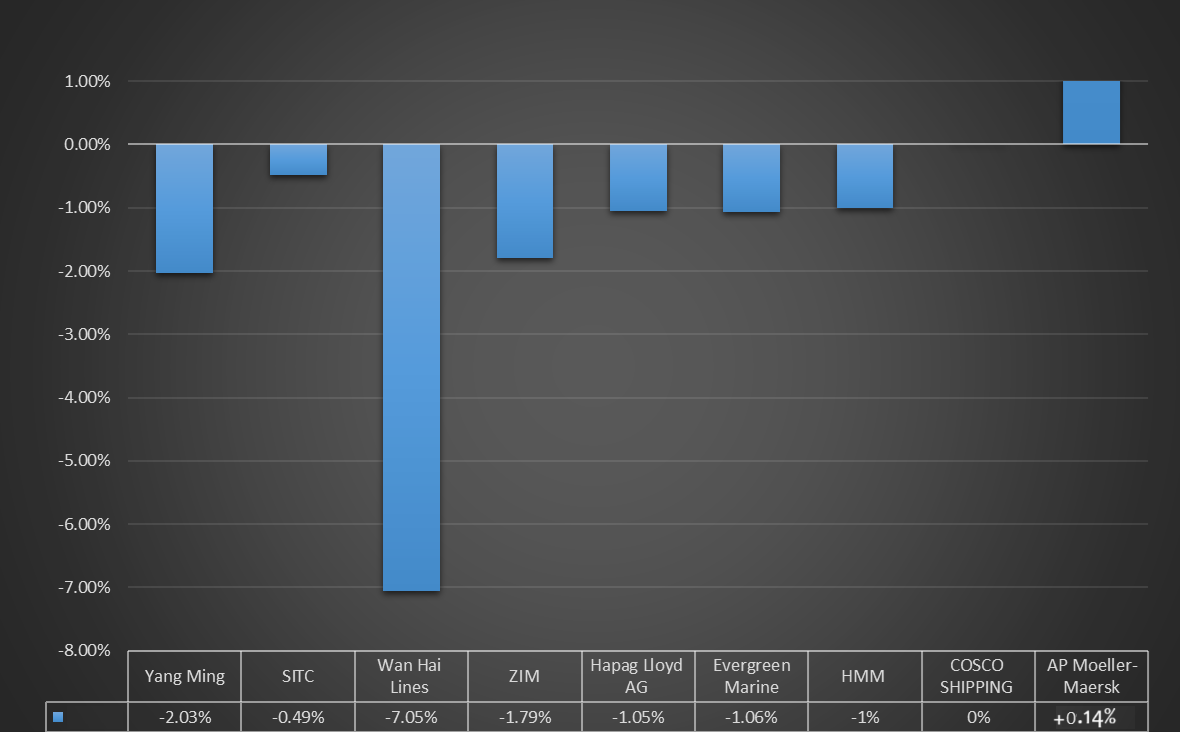

The container shipping industry has experienced notable fluctuations in stock performance over the past week, reflecting the sector’s inherent volatility. As various companies navigate shifting market dynamics, investors are keenly observing the trends that emerge during this period.

This article provides a summary of the recent stock performance of key players in the container shipping sector, highlighting the most significant movements and trends observed in the past week.

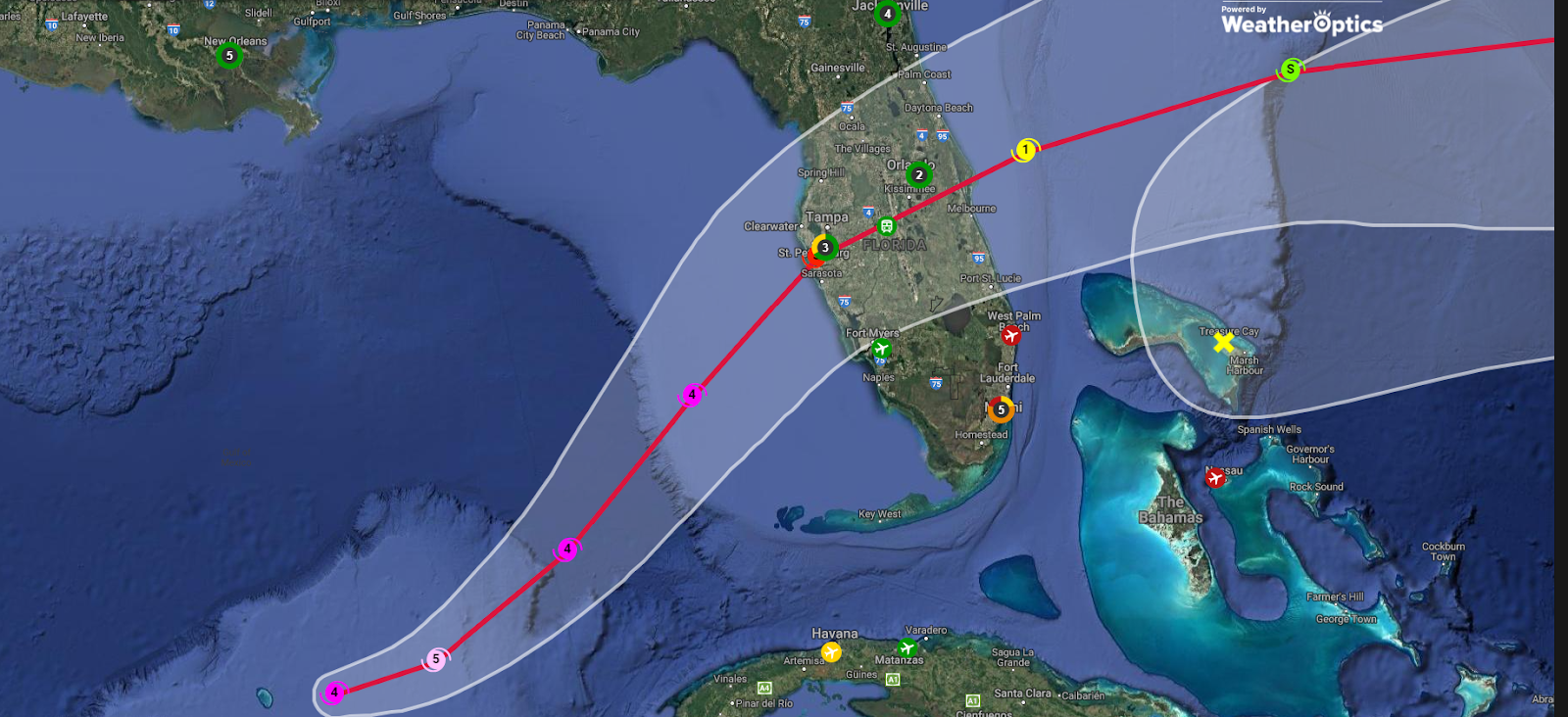

SITC International Holdings Co Ltd (1308)

Analyzing the stock prices of SITC International Holdings Co Ltd (1308) for the week following 4th October reveals some fluctuations in value. Starting on 7th October, the stock was priced at HKD 20.04. The next day, 8th October, it saw a decline to HKD 19.48, followed by a further drop to HKD 19.22 on 9th October. However, on 10th October, the stock experienced a rebound, closing at HKD 20.30. This movement indicates some volatility, but the company managed to regain momentum by the end of the week.

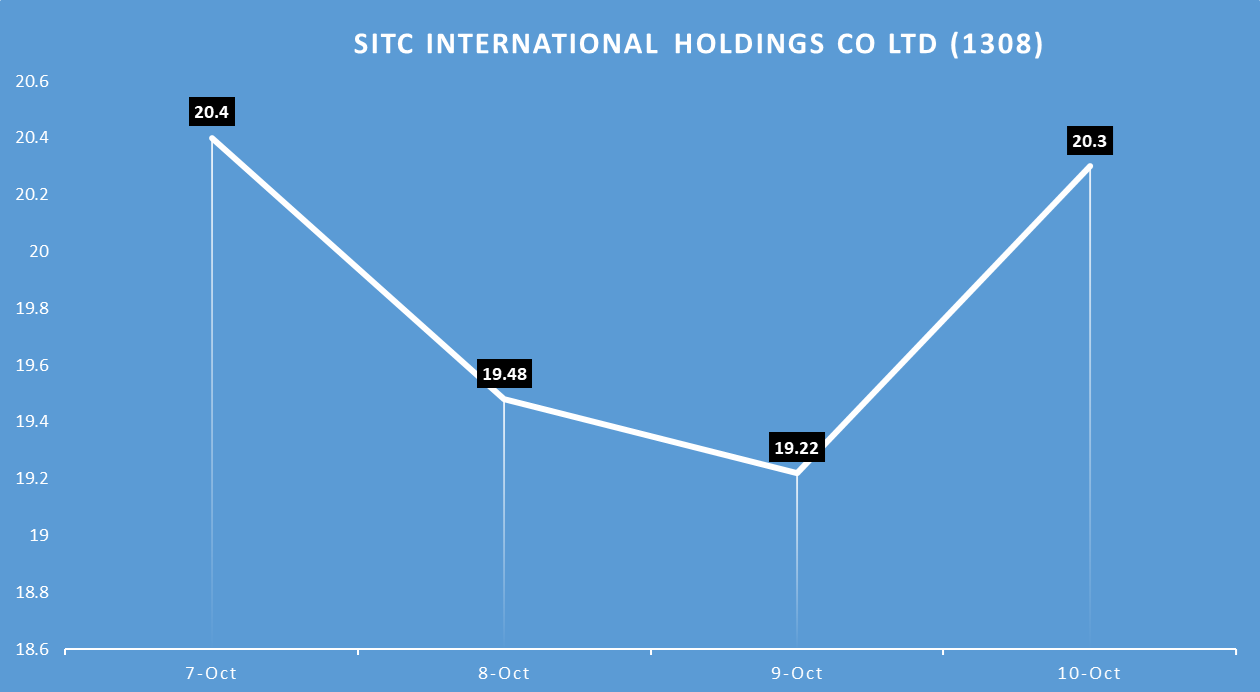

Wan Hai Lines Ltd (2615)

The stock performance of Wan Hai Lines Ltd. following 4th October shows a steady decline over the week. On 4th October, the stock was priced at TWD 89.3. By 7th October, it had decreased to TWD 85.7, and continued to fall slightly to TWD 85.5 on 8th October. The downward trend persisted on 9th October, with the stock closing at TWD 83. This consistent drop in value throughout the week may indicate challenges in market conditions or investor sentiment.

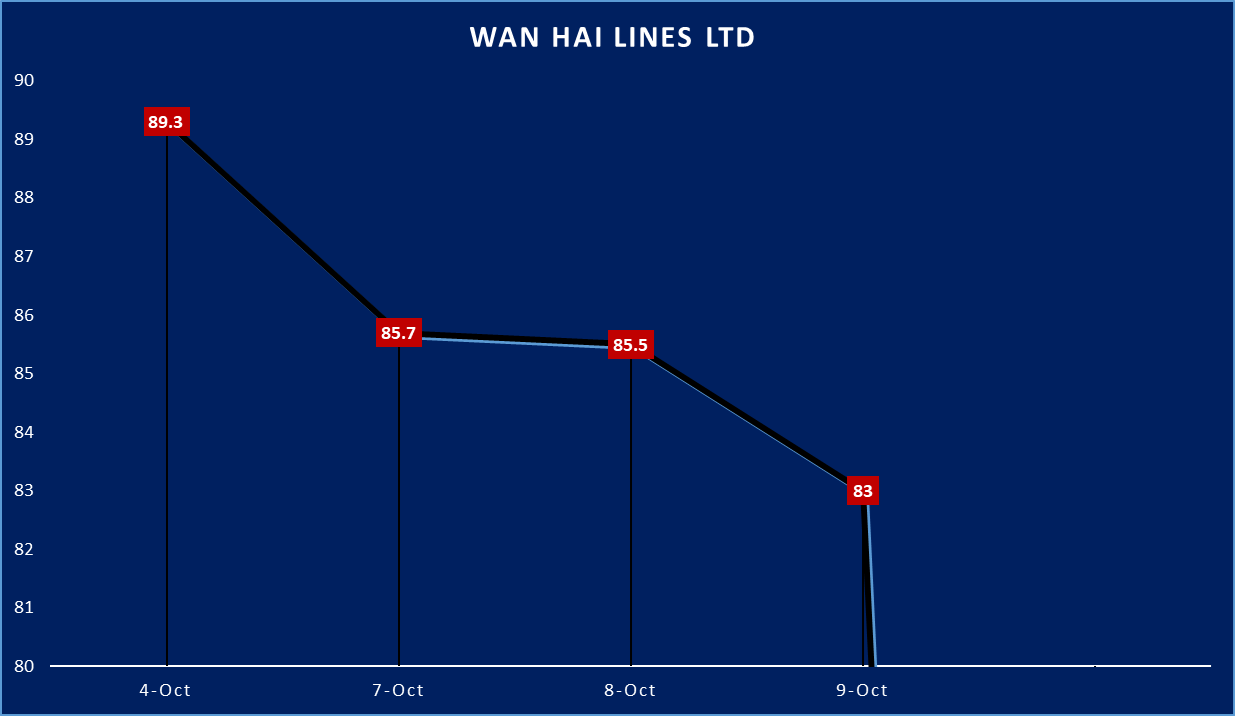

ZIM Integrated Shipping Services Ltd (ZIM)

The stock performance for ZIM Integrated Shipping Services Ltd (ZIM) from October 4 to October 10 shows a mix of fluctuations. Starting at $18.95 on October 4, the stock decreased slightly to $18.78 on October 7. It then experienced a rebound, rising to $19.44 on October 8, before falling again to $18.61 on both October 9 and October 10. Overall, the stock shows a slight decline of about 1.8% during this period, reflecting the volatility typical of the container shipping sector.

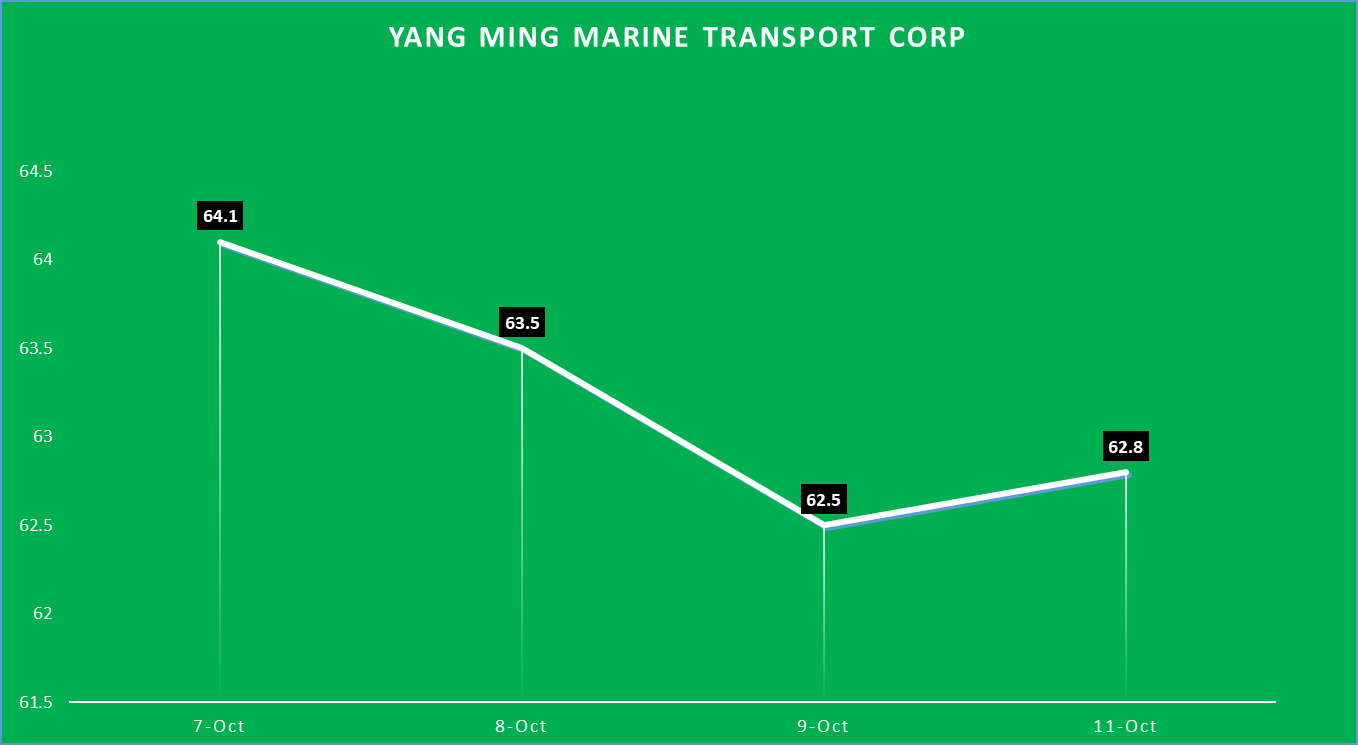

Yang Ming Marine Transport Corp (2609)

The stock performance for Yang Ming Marine Transport Corp (2609) from October 7 to October 11 shows a downward trend followed by a slight recovery. Starting at TWD64.1 on October 7, the stock fell to TWD63.5 on October 8 and further decreased to TWD62.5 on October 9. However, it experienced a minor rebound to TWD62.8 on October 11. Overall, the stock reflects a decline of approximately 2% over the period, indicating some volatility.

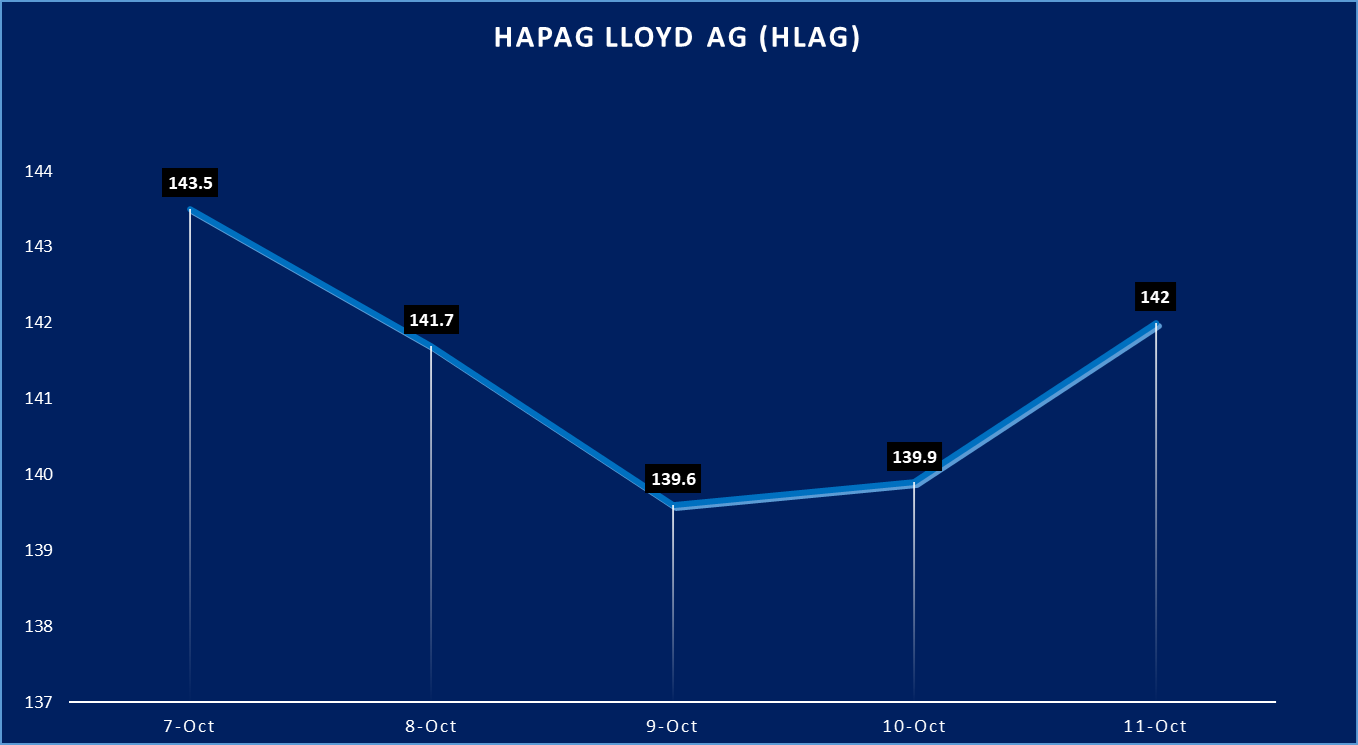

Hapag Lloyd AG (HLAG)

The stock performance for Hapag-Lloyd AG (HLAG) from October 7 to October 11 shows a slight downward trend followed by a modest recovery. Starting at €143.5 on October 7, the stock declined to €141.7 on October 8 and further to €139.6 on October 9. It then recovered slightly to €139.9 on October 10, and by October 11, it rose to €142. Overall, the stock experienced mild volatility with a small decrease of about 1% over the period.

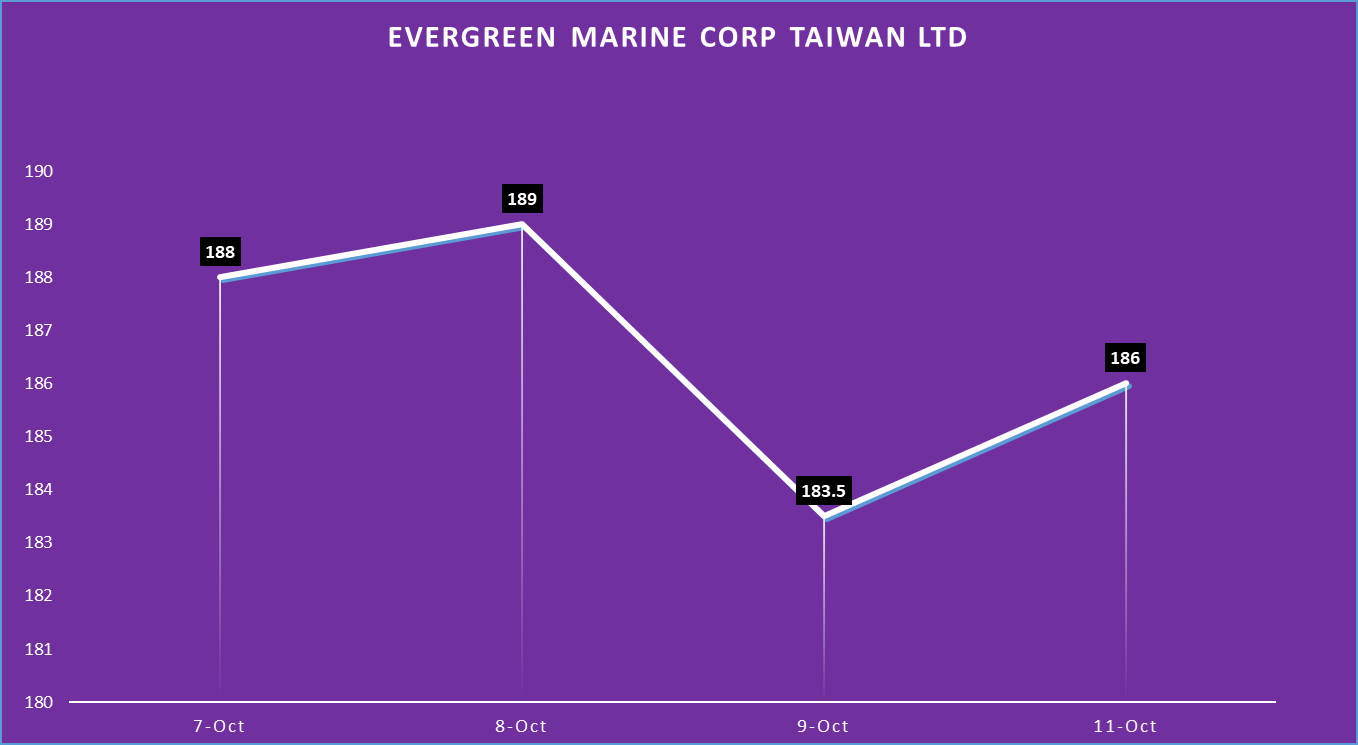

Evergreen Marine Corp Taiwan Ltd (2603)

The stock performance for Evergreen Marine Corp Taiwan Ltd (2603) from October 7 to October 11 shows slight fluctuations. Starting at TWD188 on October 7, the stock increased slightly to TWD189 on October 8. However, it dropped to TWD183.5 on October 9 before recovering to TWD186 on October 11. This reflects minor volatility with an overall decrease of about 1.1% over the period.

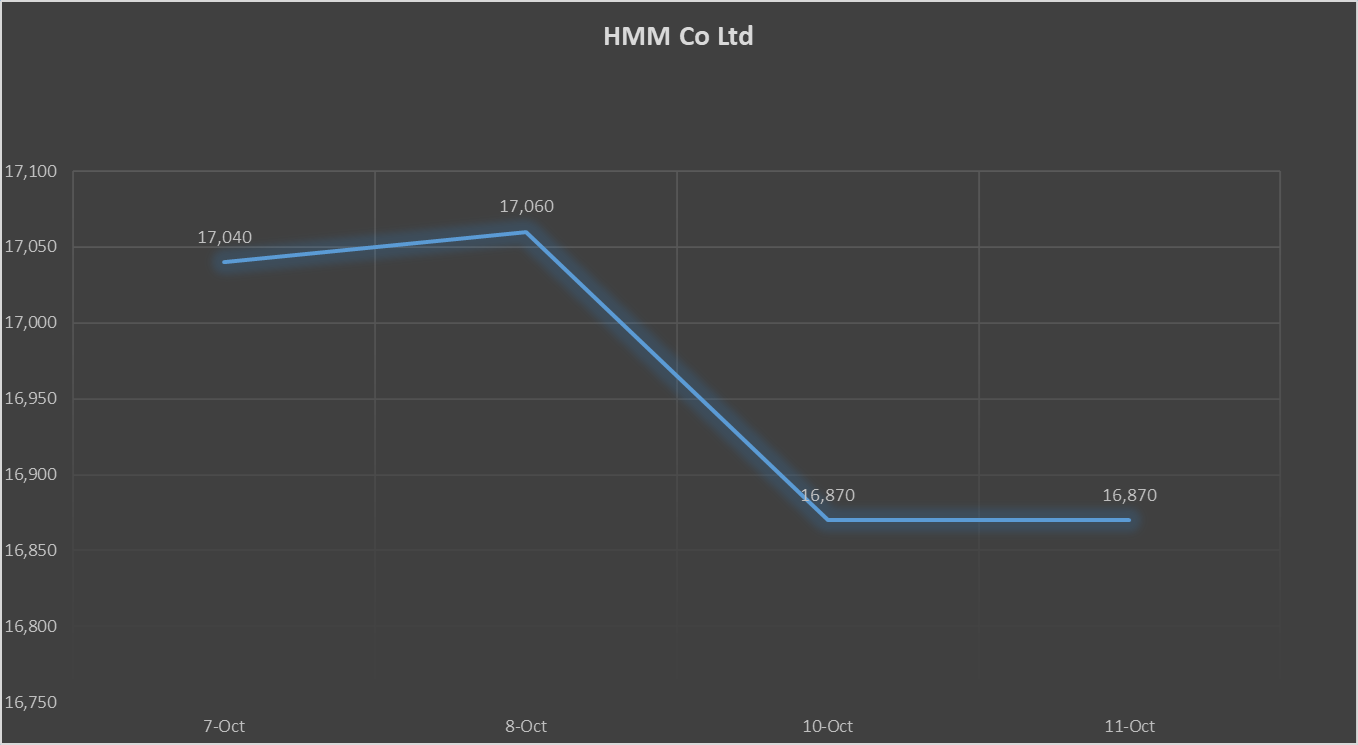

HMM Co Ltd (011200)

The stock performance for HMM Co Ltd from October 7 to October 11 shows relatively minor fluctuations. Starting at KRW17,040 on October 7, the stock slightly increased to KRW17,060 on October 8. However, by October 10, it dipped to KRW16,870 and remained unchanged at that level on October 11. Overall, the stock shows a small decline of around 1% during this period, indicating stability with minimal movement.

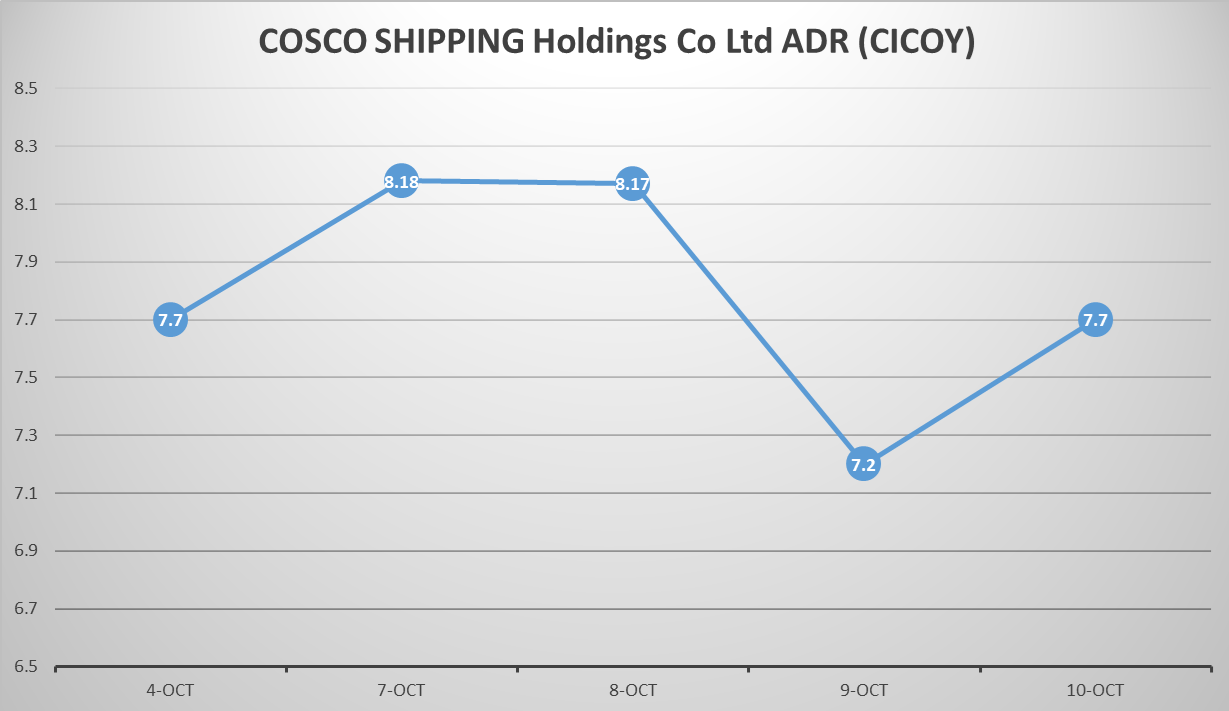

COSCO SHIPPING Holdings Co Ltd ADR (CICOY)

The stock performance for COSCO SHIPPING Holdings Co Ltd ADR (CICOY) from October 4 to October 10 shows volatility with both gains and declines. Starting at $7.7 on October 4, the stock rose to $8.18 on October 7 and remained relatively stable at $8.17 on October 8. However, it experienced a sharp drop to $7.2 on October 9 before recovering to $7.7 on October 10. This reflects a period of fluctuations, with an overall return to the starting price by the end of the observed period.

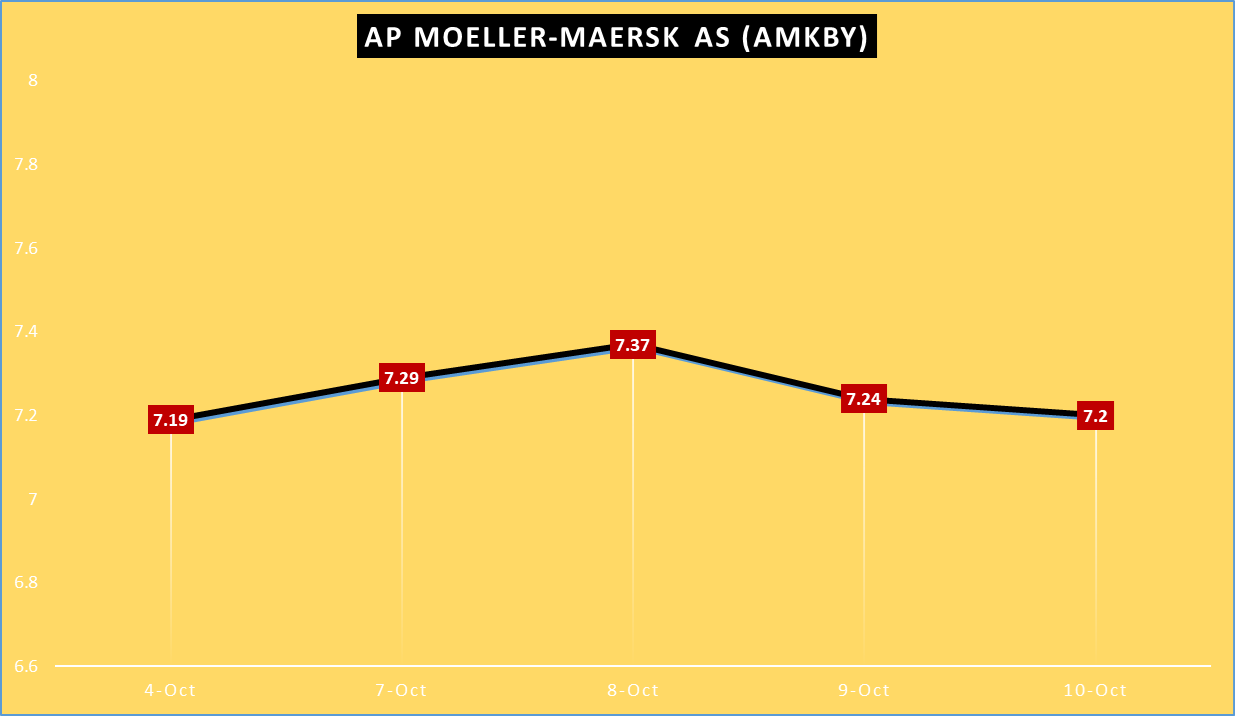

AP Moeller-Maersk AS (AMKBY)

The stock performance of AP Moeller-Maersk AS (AMKBY) following 4th October reflects slight fluctuations throughout the week. On 4th October, the stock was priced at $7.19. By 7th October, it saw a modest increase to $7.29, and this upward trend continued on 8th October with a rise to $7.37, marking the highest point of the week. However, the stock dipped on 9th October to $7.24 and declined further to $7.20 by 10th October.

The overall movement suggests minor volatility, with the stock hitting its peak midweek before slightly correcting downward.

The recent stock performance trends in the container shipping sector highlight notable volatility and fluctuations over the past week. Many stocks experienced initial declines, followed by brief recoveries, illustrating the unpredictable nature of the market. While some stocks showed slight rebounds after reaching lower prices, overall, the trend reflects a mix of stability and uncertainty. This environment underscores the challenges facing the industry, as companies navigate varying market conditions and investor sentiment. As the sector continues to evolve, ongoing monitoring of these trends will be crucial for understanding future performance.

Source: Container News