Container News recently conducted an in-depth comparative analysis of five major Chinese container ports: Shanghai, Qingdao, Guangzhou, Shenzhen, and Ningbo.

The objective of the analysis was to assess the relative competitiveness of these ports using key indicators – Data from open sources, such as UNCTAD and various national statistics, were used to construct these indicators, revealing important trends shaping China’s shipping sector.

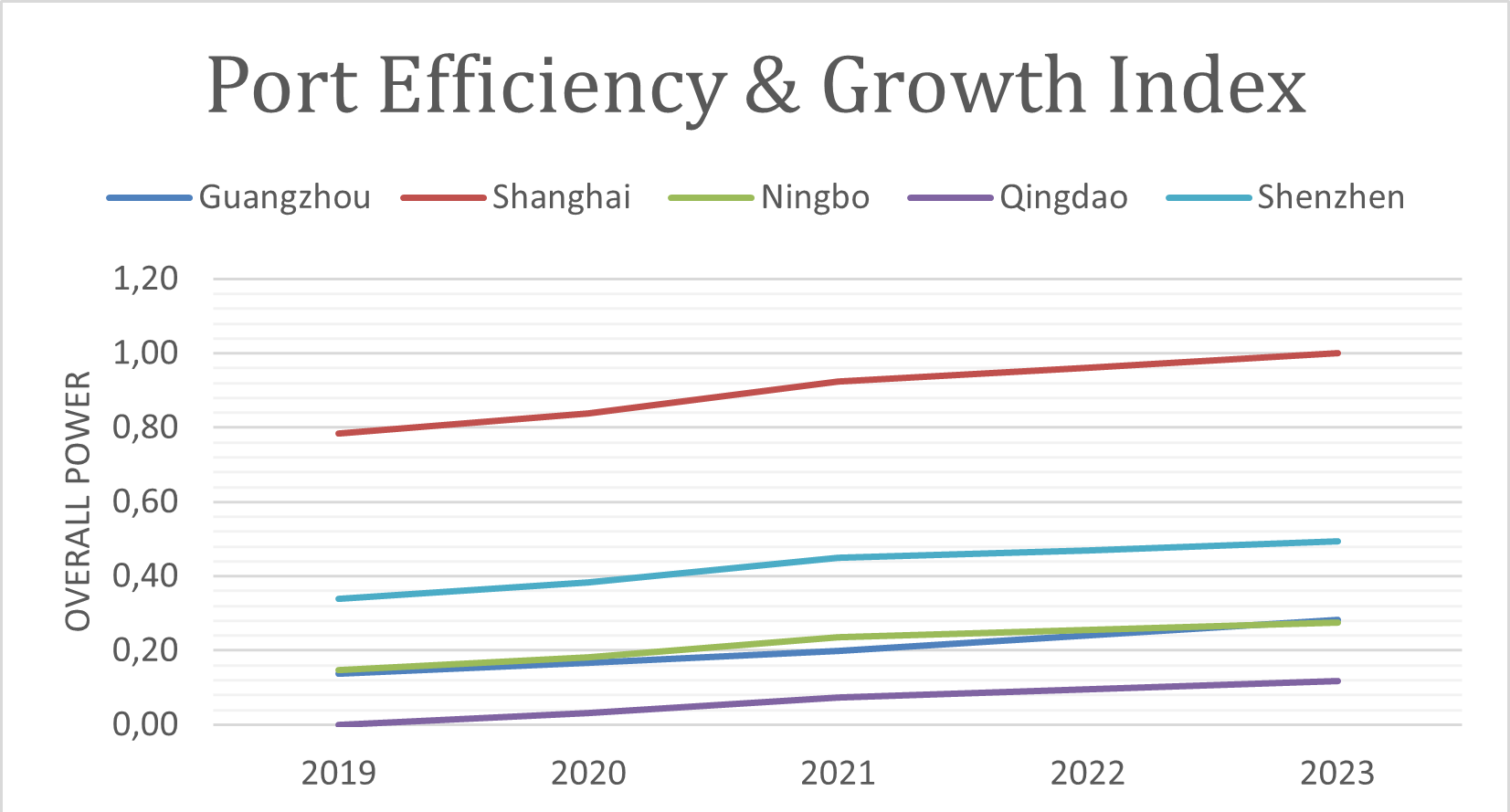

This composite index, which merges Port Throughput and Port Investments, highlights the leading role of the Port of Shanghai, which significantly outpaces the other four ports in both investment and throughput.

However, the competition between the remaining ports—Ningbo, Guangzhou, and Shenzhen—remains tight. As of 2021, Guangzhou managed to overcome a slight decline and nearly aligned its performance with Ningbo. Meanwhile, Qingdao, while ranking lowest, has demonstrated consistent growth, indicating potential for future competitiveness.

Shenzhen has maintained a relatively stable trajectory in throughput and investment, contrasting with the upward growth trend of Shanghai, which has accelerated since 2021. This stability indicates a matured and steady role for Shenzhen in China’s port ecosystem, while Shanghai continues to reinforce its position as the country’s dominant shipping hub.

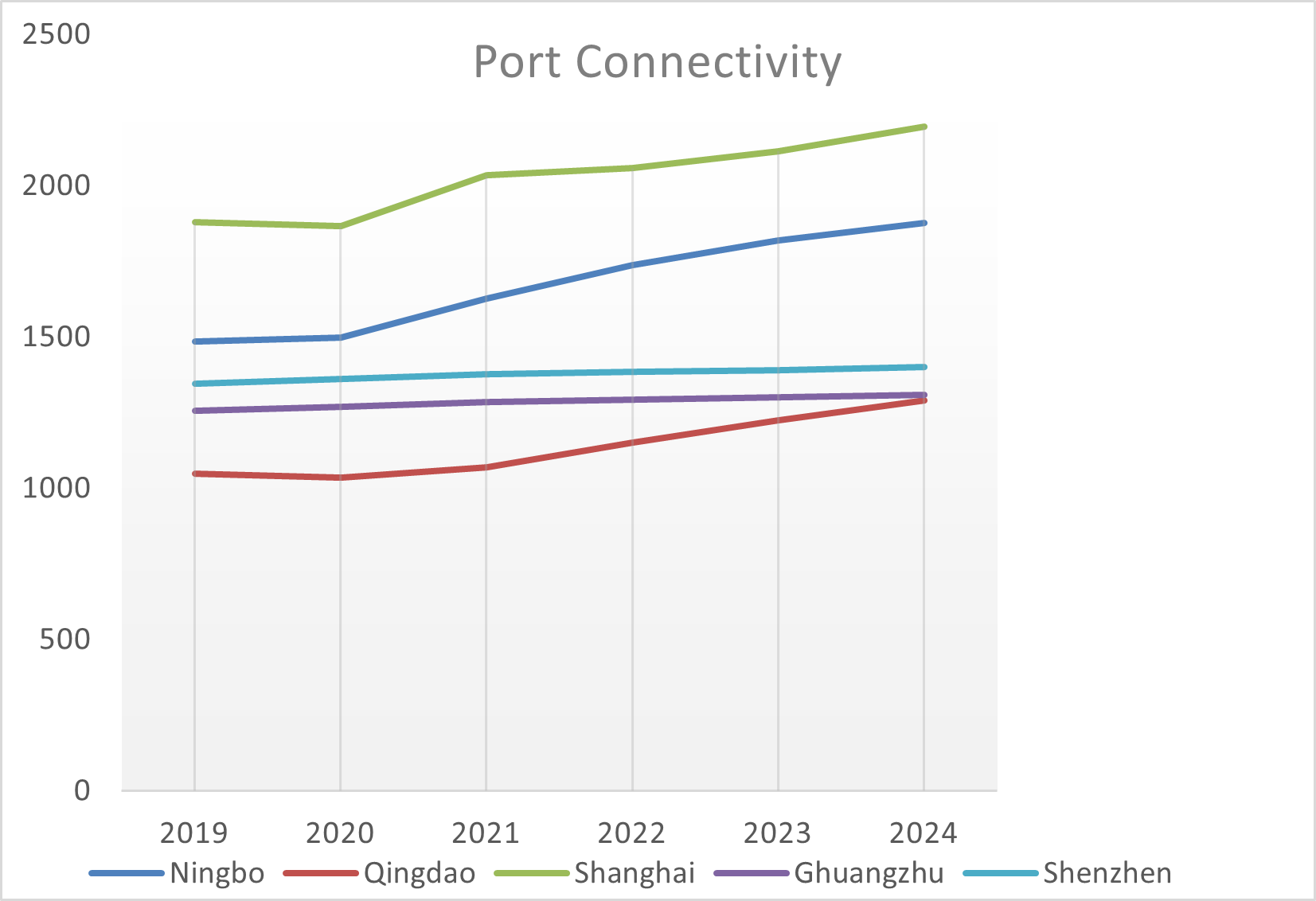

The Port Connectivity Index, sourced from UNCTAD’s Liner Shipping Connectivity Index (LSCI), provides further insights into the competitiveness of these ports on a global scale.

Once again, Shanghai stands out as the most connected port, showcasing a robust and growing connectivity trend, reinforcing its strategic importance in global shipping networks.

Ningbo, often overshadowed by Shanghai, has shown a remarkable upward trajectory since 2020. Its connectivity performance has increased significantly, narrowing the gap with more established competitors like Shenzhen and Guangzhou.

Speaking of Shenzhen, its performance remains stable, much like its standing in the Port Efficiency Index, underlining its consistent role in the Chinese maritime trade sector.

Qingdao, which experienced a downturn in connectivity in recent years, began to recover in 2022. Its recent improvements signal that the port may be poised for more robust growth if this trend continues. Guangzhou, much like Shenzhen, has maintained a stable level of connectivity, contributing to its competitive standing in China’s southern region.

In conclusion, it seems that Shanghai continues to dominate China’s container port landscape in terms of both efficiency and connectivity, maintaining its position as the global leader.

Meanwhile, Ningbo and Guangzhou are locked in a close race, with Guangzhou recovering from earlier declines.

Shenzhen’s stability across all indicators suggests a steady role, while Qingdao is gradually improving its competitive position with notable gains in both throughput and connectivity.

Source: Container News