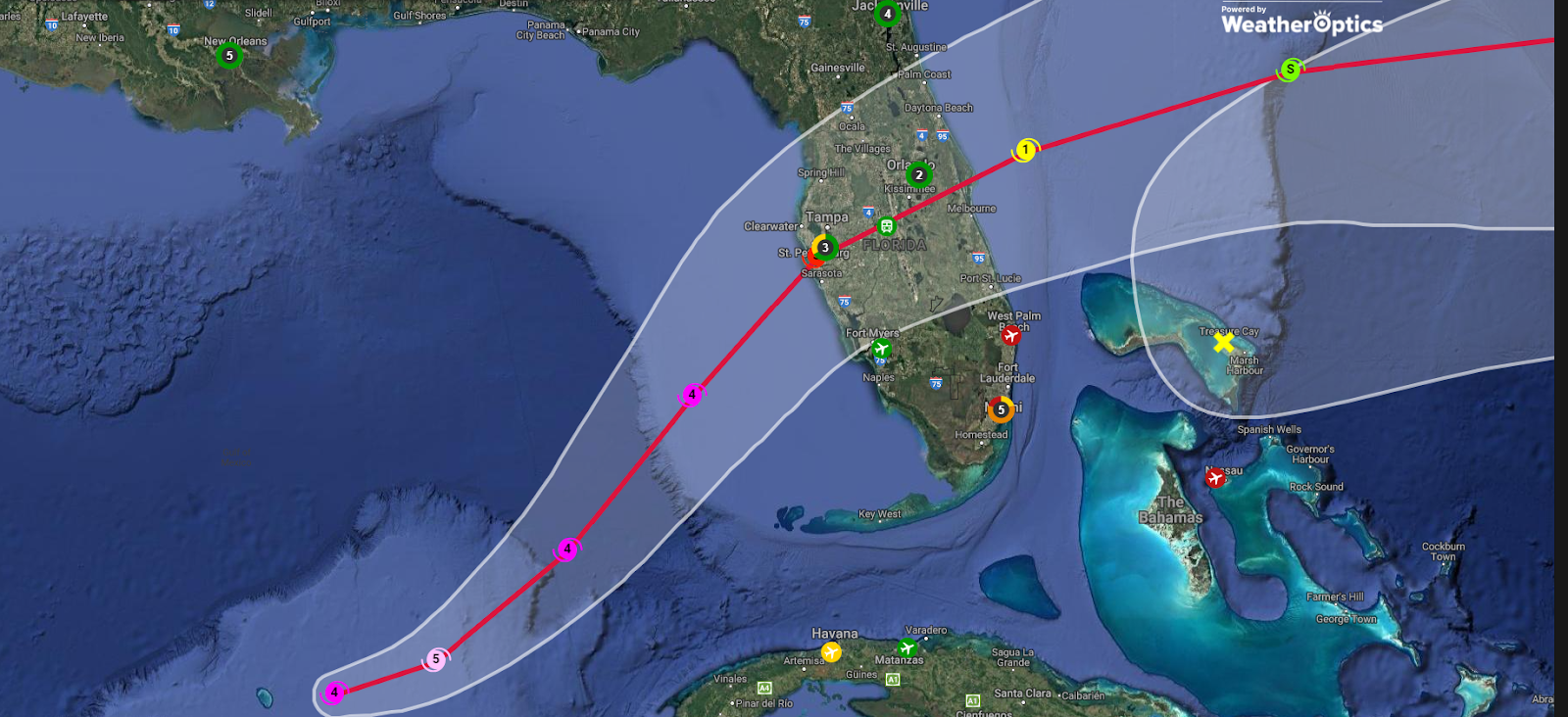

The North American freight market is experiencing its third major event in two weeks’ time. Hurricane Milton is expected to make landfall in the Tampa, Florida, area as a major Category 3 storm with maximum sustained winds around 125 mph. The storm surge is expected to be more like that of a Category 4 or 5 storm, however, making it potentially one of the strongest storms ever to hit the Tampa area.

Milton is hitting on the heels of two major market-disrupting events: the International Longshoremen’s Association (ILA) strike and Hurricane Helene.

The ILA strike, which was telegraphed well in advance, resulted in three days of lost shipping time around the major East Coast ports, including New York/New Jersey, Houston and Savannah, Georgia. The market is still recovering from the lost shipping time.

Helene may not have had a huge direct influence on national trucking capacity, as most of its impact was in more rural areas with little transportation demand, but it has put strain on the Federal Emergency Management Association (FEMA) in front of Milton.

There was reportedly a mini toilet paper and bottled water shortage in the Southeast due to some level of panic-buying mixed with disaster relief. This in combination with the port strike has resulted in some minor trucking capacity disruption.

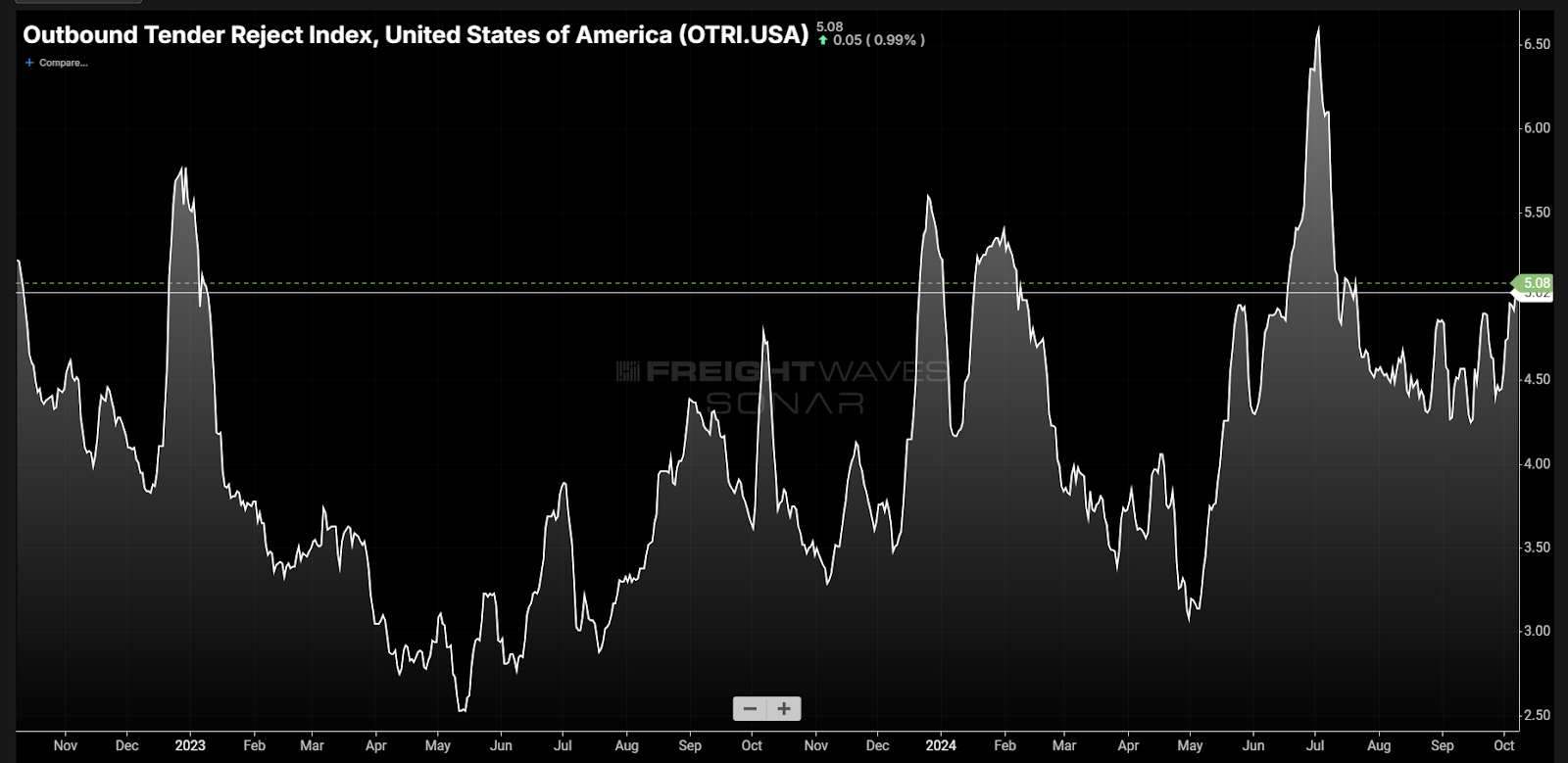

Tender rejection rates, a measure of how often carriers reject load coverage requests from shippers, have increased around many of the Eastern port markets the past few days.

National tender rejection rates (OTRI) jumped above 5% for the first time since July on Monday as a result and are currently still trending higher. The 5% threshold has only been broken four times in the past 24 months — two of them being Christmas and one being the Fourth of July this year. The fourth was a result of a strong winter weather outbreak in January in the Midwest. This was the only non-holiday-influenced tightening event of the past two years.

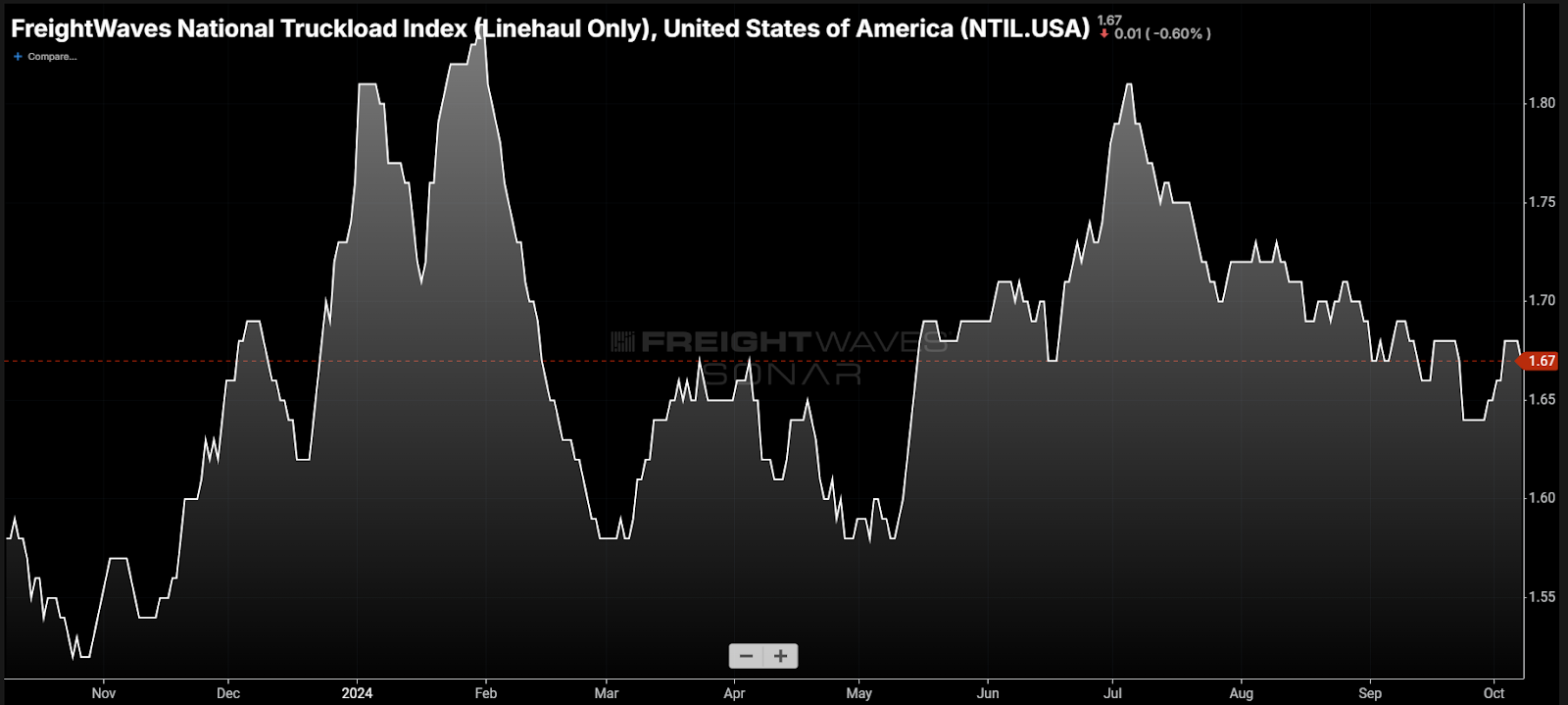

Spot rates (excluding fuel) increased marginally over the past week, suggesting that the disruption to this point has been minimal. Most of the freight impacted by the strike was regional, shorter-haul freight that is not as disruptive to national transportation networks.

Milton now bears down on an already fractured environment that was handling two pretty strong hits to its infrastructure. FEMA is now handling relief efforts on multiple fronts with some of the same areas bracing for another potentially more significant blow.

The storm is scheduled to make landfall early Thursday morning, with storm surge and flooding being the primary concern for damage. Flooding is the No. 1 damage producer from tropical systems and takes months if not years in some cases to recover from.

Hurricane Harvey in 2017 was not a major hurricane but sat over the Houston area for several days, forcing shippers to close facilities. The result was a catalyst for one of the longest-running freight market capacity shortages in modern history.

The Tampa/Lakeland, Florida, market is a moderately sized outbound freight market, originating roughly 1.5% of all the freight in the U.S. over the past year — the 18th-largest. It is the sixth-largest inbound market, being the destination for approximately 2.7% of all the truckload freight in the U.S., according to FreightWaves tender data.

There will inevitably be disruptions to shipping networks as the region is shutting down in front of the storm. Then it will be a waiting game as crews evaluate and start to repair the damage to the infrastructure. Trucks will be summoned from across the country to provide relief.

FEMA loads require much more time and effort as the freight does not go to docks but to disaster zones with limited resources for unloading and distributing freight. Short-haul loads require days at times. Trailer pools will be depleted.

The national freight market has absorbed two decent hits fairly well, but can it handle the third? Milton could be the straw that breaks the market’s back.

Source: freightwaves