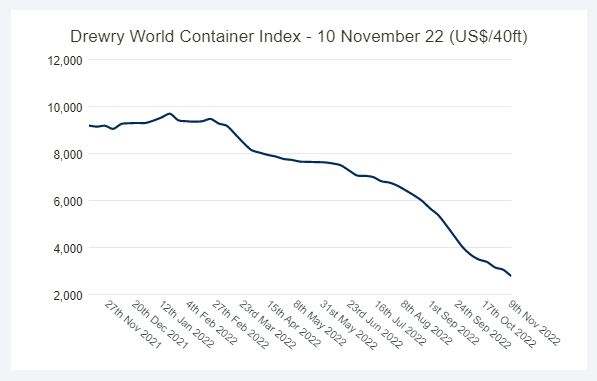

Drewry’s World Container Index (WCI) took a 9% beating this week to end at US$2,773, which is the lowest-ever figure over the past 24 months.

Having slipped past the US$3,000 mark, the index has lost 86% of its gains accumulated since the pandemic period. This is signaling towards the path that the slip in spot rates is yet to be over, despite a reported decrease in services, especially in the Transpacific trade and a high number of blank sailings.

The World Container Index is now about 26% off the five-year average of US$3,759. The trade lanes from China to Europe and the Mediterranean saw the spot rates dunk by 13% and 15% respectively.

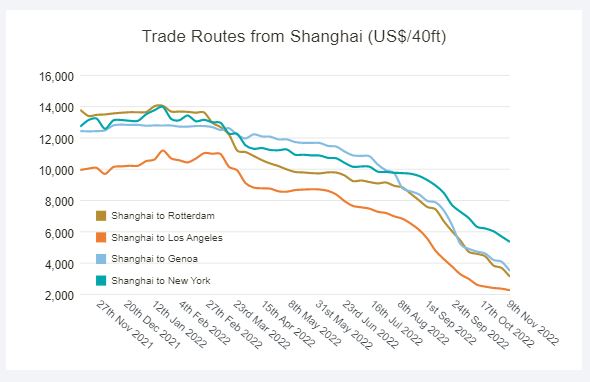

The Shanghai-Rotterdam stretch saw the rates falling to US$3,126, while Shanghai-Genoa slipped to US$3,494, a drop of over US$10,000 since its peak of US$13,765 in October 2021.

The rates for China-US trade too have been inching lower, but at a lesser magnitude than the China-Europe rates or the weekly falls, that we witnessed in September and October 2022.

Spot freight rates by major route – Drewry’s assessment across eight major East-West trades:

The Drewry’s commentary is still dovish about the rates, which are expected to remain mildly lower for the next couple of weeks.

Source: Container News