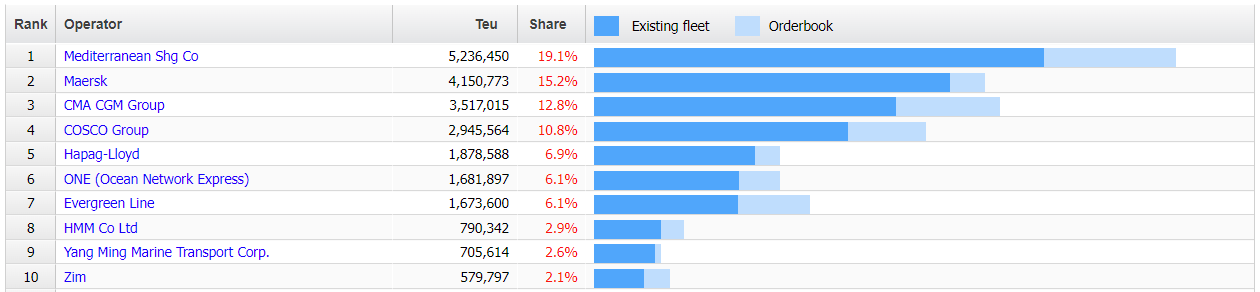

Singapore-headquartered Ocean Network Express (ONE) is looking to leapfrog its THE Alliance partner Hapag-Lloyd as the fifth largest carrier with a sustained fleet growth of around 10% per year to the end of this decade.

The company said in its recently released ONE 2030 strategy that it will invest US$25 billion in its fleet to add close to 1.2 million TEUs in capacity, taking its standing fleet to 3 million TEUs.

Stefan Verberckmoes, senior analyst at Alphaliner said, “One of the main reasons explaining the strategy is that they are aware that a carrier needs economies of scale to be profitable to finance decarbonisation.”

However, former research analyst Mark McVicar believes, “The move is an attempt to gain market share, but in order for the market to remain buoyant it relies on the assumption that others will cede market share.”

Fleet growth for the Singapore-based line will increase over the six-year period from around 4%, which is below the level of market growth, to 10% annually, higher than the projected market growth to the end of the decade. Accountants PWC projects annual global GDP growth of around 3-3.5%.

“ONE should realise an annual fleet growth of around 10% until 2030 to reach its goals. That’s indeed a very ambitious plan in a market where moderate growth and overcapacity is expected,” added Verberckmoes.

The ONE 2030 plan includes delivering sustainable solutions for its vessels to meet new regulations and the acquisition of terminals in key regions of the world.

In addition, the company will identify key growth regions, with increasing cargo flows, strengthen its customer service support, meeting customers’ requirements for digitalised services.

Moreover, ONE expects to move into areas within the logistics “value chain”. Dynamar analyst Darron Wadey said the company cites its moves for Atlas and the terminal operations of its Japanese shareholders, MOL, NYK and K Line.

Wadey also points out that “No specific mention of logistics has been made,” and that the company has allocated some US$10 billion to develop these what ONE calls “adjacent” businesses.

He added, “Should ONE make a definitive move into container logistics, this could be facilitated by its shareholders in a similar way to how it entered into container terminal investments, namely taking over stakes held by its parents.

“Buying into its parent’s already well-established and extensive logistics presences would make sense. For starters, ONE would not be burdened by expensive start up from scratch costs. It would also avoid creating a competitor to its shareholders’ existing activities.”

Transforming its fleet and services will mean that the carrier will target US$3.8 billion profits by the end of the implementation period, an aim that McVicar described as “reasonable”.

According to ONE, the initial two years of ONE 2030 are the years during which the industry may be affected by newbuildings. However, due to geographic and political factors such as the ongoing Red Sea crisis, it is rather difficult to predict the profit level in a logical manner, said the company.

Nevertheless, ONE predicts that after these two years, profits will be boosted by a better supply and demand balance and that its returns will also improve as a result of the early benefits of its strategy.

Source: Container News