Drought in Panama and war around the Red Sea and Suez is a slow-burning but developing crisis for the container shipping industry as both canals become choke points that could see freight rates double.

As the rainy season in Panama comes to an end, and notwithstanding the announcement that rain has raised water levels allowing the Panama Canal Authority to increase the number of daily transits, the outlook for next year remains tight.

Chief analyst at Xenata, Peter Sand, said the dry season could see services for the US East Coast diverted via Suez though with the security situation in the Red Sea deteriorating the industry may face some tough choices regarding the routeing for services.

“Rates could easily double as a consequence,” said Sand, adding, “There are seven weekly services that transit the Panama Canal, if they were all to be re-routed via Suez that would require an extra three ships on each service to maintain the weekly calls.”

He qualified that saying that vessels would have to operate at current speeds, but if they increased speeds by a single knot it could reduce the requirement to two ships, while slowing down could raise the number to four extra ships.

“Shippers had been hoping for a period of lower rates but now with both canals becoming choke points the upshot could see delays to cargo, higher costs and greater uncertainty,” claimed Sand, “I call it a slow-burning disaster”.

With July the next rainy season in Panama there will be a need for the canal reservoirs to be replenished, but if the rains fail to lift the water levels sufficiently in the next rainy season the delays and restrictions could last into 2025, said Sand.

One source also pointed to the fact that the demand on the Panama Canal reservoirs is not only from the maritime sector but the water is supplied to the growing population in the canal region, putting further pressure on the water levels and probably adding to ship delays said a maritime source, who preferred to remain anonymous.

VesselBot, an Athens-based tech company, has analysed the current number of vessels waiting to transit the Panama Canal, with the extra emissions from extended waiting times included.

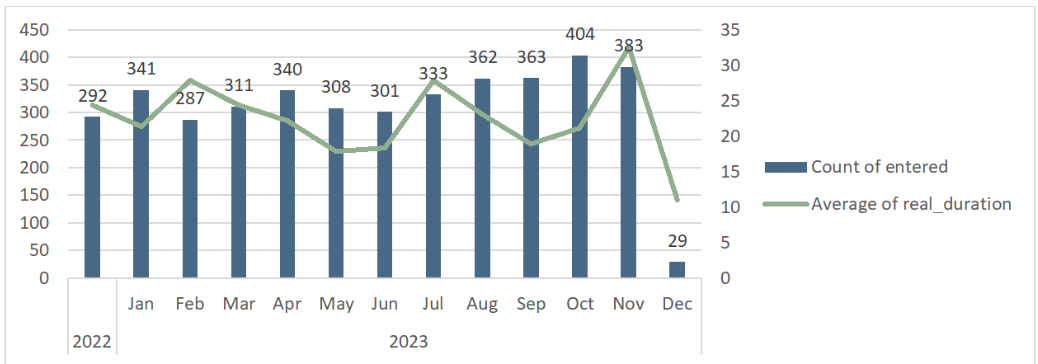

CEO and founder at VesselBot, Constantine Komodromos, said, “The peak for vessels entering the [Panama Canal] anchorage concluded in October, and there was a bottleneck in November. As shown in graph 1, in October, 404 vessels entered both anchorages and resulted in an average of 32.55 hours waiting at anchorage in November, making it the peak anchorage waiting time through the year.”

Due to the peak of shipping vessels entering the anchorage concluded in October, there is a bottleneck in November. As shown in the graph, in October, 404 vessels entered both anchorages resulting in an average of 32.55 hours waiting at anchorage in November, making it the peak anchorage waiting time through the year. Source: VesselBot

November arrivals had already decreased at the entrances to the canal, explained Komodromos, because of the waiting times, with some vessels re-routing via Cape Horn. However, he added fewer ships are arriving precisely because of the transit delays.

“Vessels when anchored consume fuel for a number of operational reasons, mostly for auxiliary engines. Therefore, the increased waiting time and the higher number of vessels waiting in the anchorage led to the highest emissions produced at anchorages around the Panama Canal,” noted Komodromos.

November saw a spike in emissions to 12,000 tonnes in greenhouse gas emissions, an increase of more than 5,000 tonnes since January of this year, according to Komodromos.

An increase in the emissions from shipping is expected to be seen as both the limitations on the Panama and Suez Canals persist.

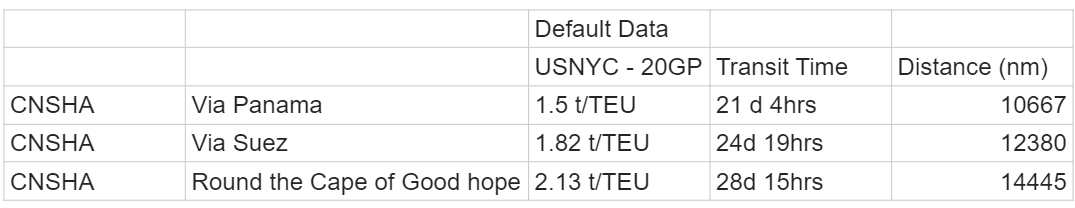

SeaRoutes, an emissions tracking tech company, has calculated that vessels transiting the African Cape, rather than heading via Suez will substantially increase fuel consumption and therefore emissions.

In its calculations, SeaRoutes estimates the emissions for a vessel operating from Shanghai to New York via Panama, Suez and the Cape, with the shortest route via Panama and the distance via Suez around 40% longer adding more than half a tonne of CO2/TEU plus more than 30% to the journey time.

Even with the evidence of higher costs for the carriers diverting traffic to avoid the canal choke points, shippers remained unimpressed with the “price signalling” from Xeneta.

James Hookham, director at the Global Shippers’ Forum, pointed out that there are alternatives to the Panama Canal. “We may well see cargo from Asia to the East Coast returning to the Californian ports and using rail to ship to the Midwest,” he said.

Hookham forecasts that should Houthi missiles target gas and oil tankers the US and European nations will need to act to protect commercial shipping, if only to prevent energy prices from spiralling out of control and forcing inflation up again.

That forecast has now come to fruition with escorts led by US forces likely to start in the near future.

Source: Container News

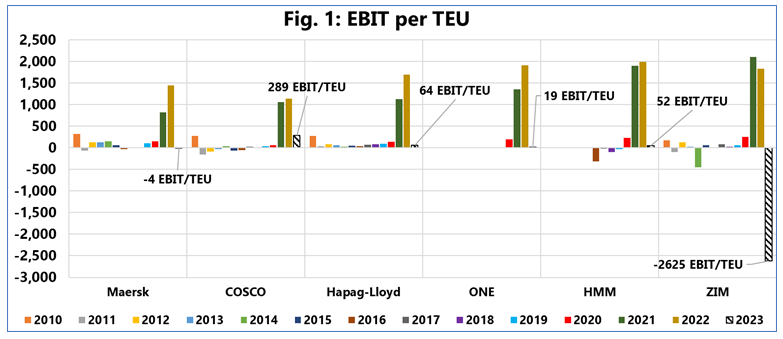

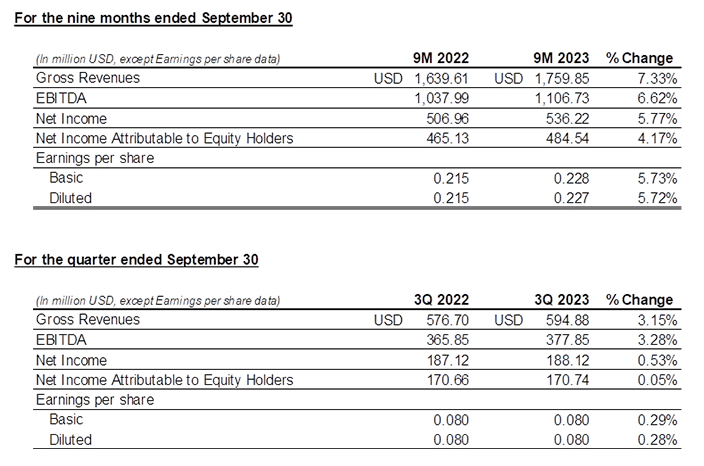

All major shipping lines that report on their financial figures have recorded sharp year-over-year revenue drops in the third quarter of 2023, according to the latest Sea-Intelligence analysis.

All major shipping lines that report on their financial figures have recorded sharp year-over-year revenue drops in the third quarter of 2023, according to the latest Sea-Intelligence analysis.