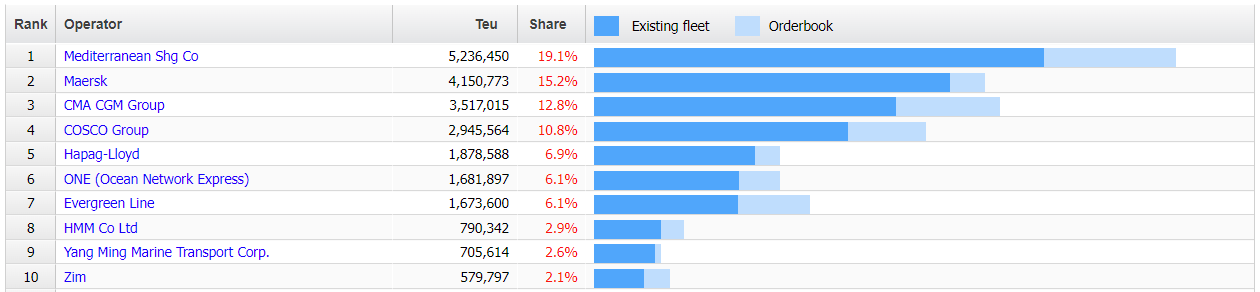

Taiwanese ocean carrier Evergreen has lost the sixth spot in the global liner rankings by Singapore-headquartered Ocean Network Express (ONE), according to the latest data (23 August) by Alphaliner.

This is not expected to be a permanent change, as Evergreen’s newbuilding orderbook is significantly larger than ONE’s. The Taipei-based box carrier is looking even higher, as it is very likely to surpass German Hapag-Lloyd, based on the companies’ current newbuilding boxship orders.

However, the Hamburg-based firm seems to explore its options in order to maintain and enhance its global presence. Hapag-Lloyd has lately emerged as another possible buyer of South Korean box line HMM.

In the case of HMM acquisition by Hapag-Lloyd, the Germans will secure their current fifth spot and will be able to challenge Chinese shipping giant COSCO for the fourth spot. Additionally, the potential takeover of HMM will bring a near double-digit market share for the first time in Hapag-Lloyd’s history.

Furthermore, regarding the “podium” of Alphaliner rankings, MSC remains at the top widening its gap from its Danish and French competitors, while as already reported CMA CGM is on track to surpass Maersk and become the second-largest container carrier in the world.

Source: Container News