Container lines are rapidly expanding connections out of South India to keep pace with growing trade volumes.

But the concentration of calls at private box terminals operated by Adani Group, which act as alternatives to Chennai Port, is becoming increasingly evident.

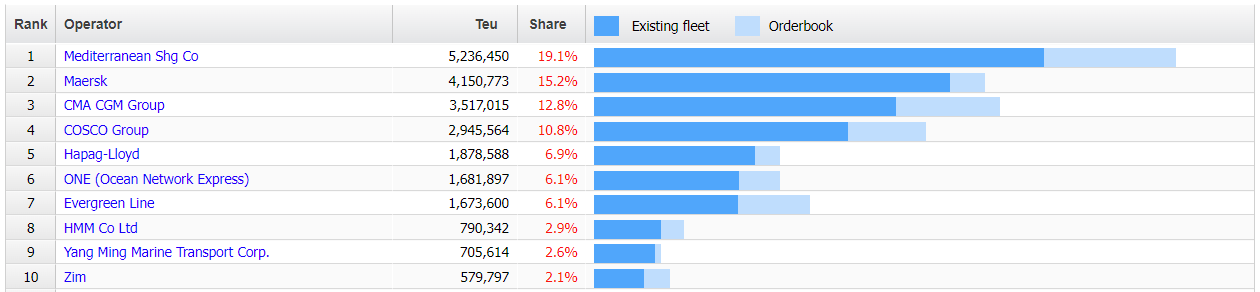

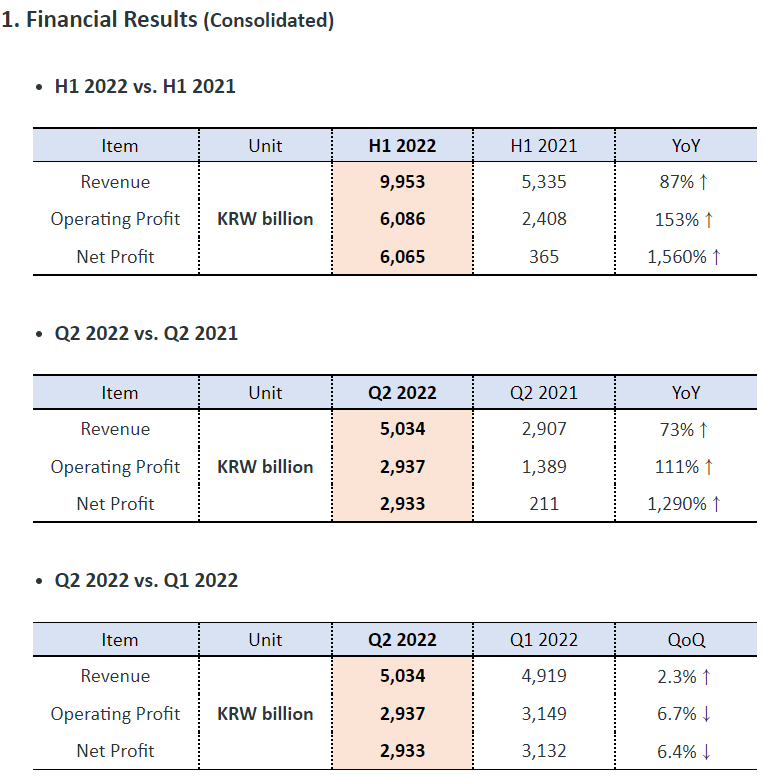

HMM has cemented its network with direct sailings out of Adani Kattupalli Port (AKPPL). Its FIM [Far East Asia-India-Mediterranean] service is a major boon for southern India shippers traditionally tethered to transshipment over Sri Lanka’s Colombo Port for mainline connections.

The FIM rotation is Busan, Kwangyang, Shanghai, Ningbo, Shekou, Singapore, Port Klang, Kattupalli, Nhava Sheva, Mundra, Karachi, Jeddah, (Suez Canal), Damietta, Piraeus, Genoa, Valencia, Barcelona, Piraeus, Damietta, (Suez Canal), Jeddah, Karachi, Mundra, Nhava Sheva, Kattupalli, Singapore, Da Chan Bay and back to Busan.

In addition, CMA CGM has opened a new string out of Adani Ennore Container Terminal (AECTPL) for North Europe and the Mediterranean. The NEMO [North Europe-Mediterranean-Oceania] Service rotates Ennore, Colombo, Malta, Valencia, London Gateway, Rotterdam, Hamburg, Antwerp, Le Havre, Fos Sur Mer, La Spezia, Malta, Pointe Des Galets, Port Louis, Sydney, Melbourne, Adelaide, Singapore and Ennore.

“This new call will offer our customers a fast export connection from the main commercial area in South East India to Europe together with a direct import connection from Australia and Singapore,” said CMA CGM in a customer advisory, announcing the Ennore call.

The carrier further noted, “Ennore is also a natural gateway from/to ICD [inland container depot] Bangalore covered with an efficient rail connectivity and will provide a best-in-class service to the fast-growing automotive industry.”

The NEMO competes directly with Maersk’s ME7 Service, connecting South India trade via Ennore to North Europe.

The ME7 port rotation is Ennore, Colombo, Salalah, Algeciras, Felixstowe, Rotterdam, Bremerhaven, Jeddah, Salalah, Colombo and Ennore.

With more call additions, Kattupalli and Ennore have already made sizeable inroads into the Chennai market. According to available data, Kattupalli saw 58,046 TEUs last month, while Ennore handled 59,985 TEUs.

The growing shift of volumes to emerging port locations poses challenges for box terminals at Chennai Port, putting further investment in capacity development there at risk.

Source: Container News