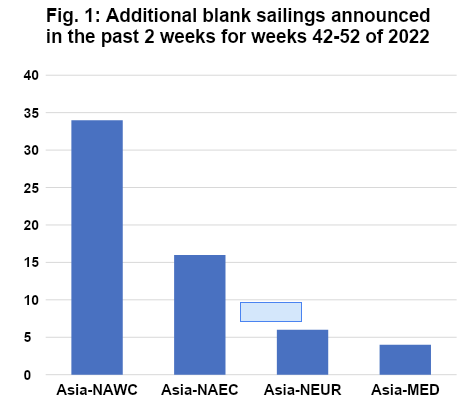

Sea Intelligence, with the help of the Blank Sailings Tracker, looked at how carriers are reacting to the collapse of demand, particularly for imports to North America and Europe, in terms of blanking sailings.

The following figure shows a snapshot of the additional blank sailings that were announced (or unannounced ones that were captured by Sea-Intelligence) for the week 42-52 period.

The number of void sailings has been ramped up drastically on the Transpacific, but not so much on Asia-Europe, according to Sea-Intelligence’s report.

There have been 34 additional blank sailings on Asia-North America West Coast, and 16 on Asia-North America East Coast. For the former, carriers have announced an extra 7-11 void sailings in all but five weeks of the analysed period.

However, for weeks 51 and 52, carriers have scheduled no blank sailings on Asia-North America West Coast.

“This is a reflection of the carriers’ indecision as to how to approach the potential pre-Chinese New Year rush. It appears more to be a wait-and-see approach, in terms of whether there will be a seasonal demand spike,” commented Alab Murphy, CEO of Sea-Intelligence.

On the other hand, on Asia-Europe, there is not a similar trend, with Asia-North Europe only seeing an additional six void sailings, and Asia-Mediterranean seeing an additional four blank sailings.

Source: Container News