While some shipyards struggled to stay afloat during the initial outbreak of Covid-19, the post-pandemic environment is predicted to usher in an encouraging era for shipyards’ orderbooks.

In 2020, orders for container ships fell to their lowest number in a decade and dry bulk and tanker orders experienced similar slumps. Both 2021 and 2022 saw an uptick in orders, and shipping analysts now predict that 2023 will again see high levels of orders across all sectors, raising concerns of a potential oversupply. Demand for newbuilds is such that many shipyards are finding it increasingly difficult to accommodate new orders.

Impact on financing

The enormous orderbook predicted for 2023 begs the question: where is the capital coming from to finance all these newbuilds?

The answer may lie in creative financing solutions and the diversification of funding sources. Earlier this year, it was announced that one shipowner secured financing for its dozens of newbuilds through various financing structures. These included a set of export credit agency backed loans, sale and leaseback arrangements, syndicated bank loans, and equity. Other shipowners have been seen to turn exclusively to sale and leaseback financing to fully cover their large newbuild programmes. Still, some continue to rely on traditional equity and debt finance.

It is clear, therefore, that despite this surge in orders, shipowners continue to seek, and find, diverse and alternative sources of ship finance.

Charter rates

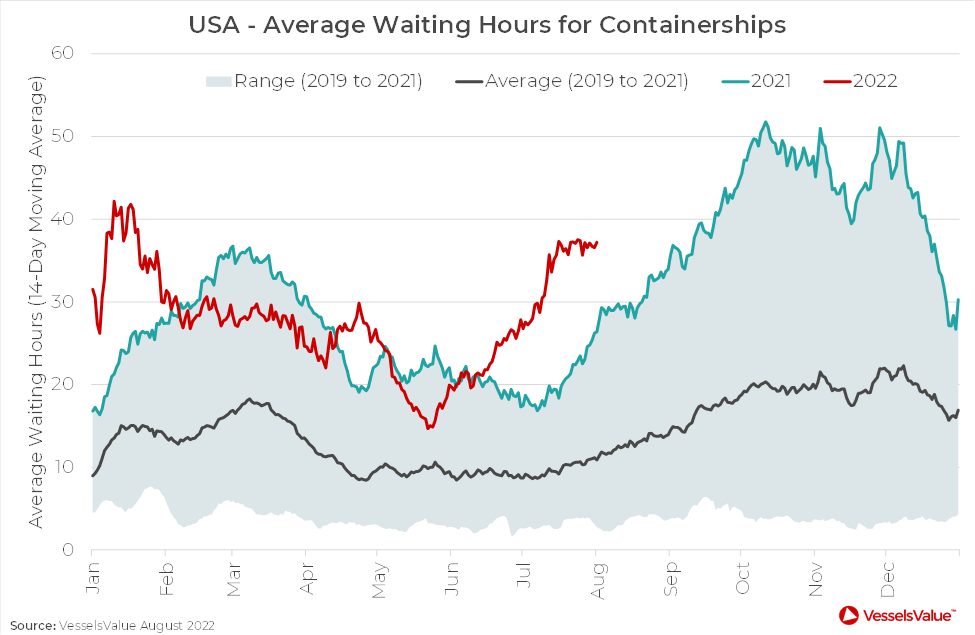

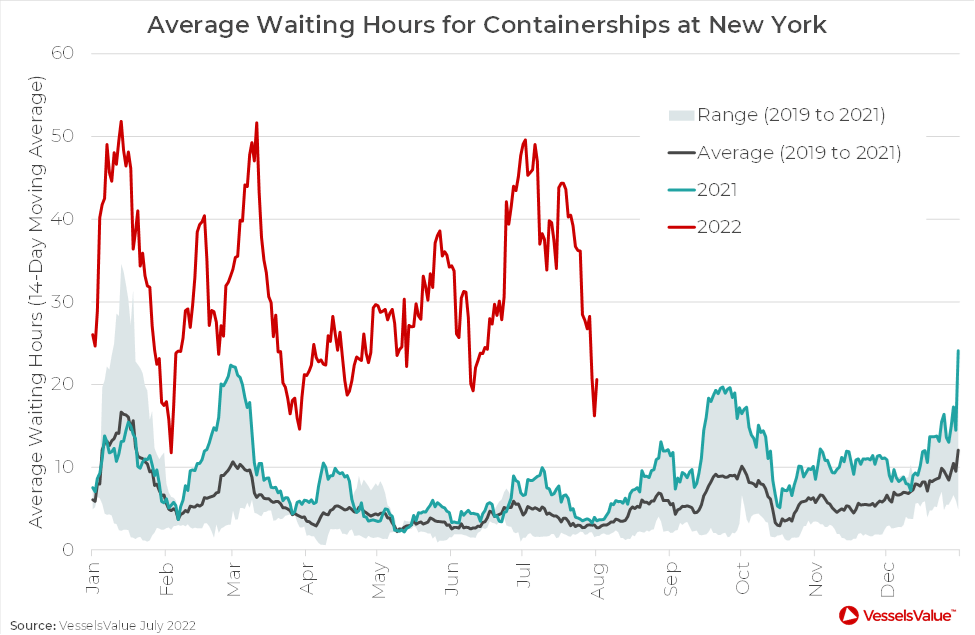

Recently, charter rates have reached record-breaking highs, driven largely by the soaring demand for capacity following the post-pandemic boom. This lack of ships has given shipowners the upper hand in charter negotiations, allowing them to achieve higher rates and longer hire periods.

Accordingly, one could posit that this surge of newbuild orders may alleviate carriers’ concerns around the meteoric rise of charter rates. However, long lead times for newbuild orders will likely result in this additional capacity not being felt for some time. It remains to be seen whether charter rates will stabilise to pre-pandemic levels once newbuilds that are currently on order are eventually launched into operation.

A degree of caution should be exercised by owners if the increase in newbuild orders indeed leads to an oversupply of vessels. An increase in capacity will spell a decrease in charter rates. This may impact owners’ ability to pay back their financing obligations and care should be taken when negotiating employment contracts. While adequate protections should always be put in place to ensure timely repayment of loans and interest, concerns around this are likely to be exacerbated by fears of a drop in a vessel’s earning potential.

Source: Container News