LCL export service from Vietnam to Muara, Brunei

Port of Los Angeles surpasses 740,000 TEUs in March

In March, the Port of Los Angeles saw a remarkable surge, handling 743,417 container units, marking a 19% increase compared to the same month in the previous year.

This achievement marked the eighth consecutive month of year-over-year growth at the busiest port in the United States.

During the first quarter ending on 31 March, local dockworkers facilitated the movement of 2,380,503 TEUs across Los Angeles marine terminals, representing a nearly 30% rise from 2023. This performance ranks among the Port’s strongest first-quarter starts, second only to the import surge witnessed during the pandemic in 2021 and 2022.

“Moving into April and the second quarter, I expect robust cargo flow to continue here. A strong job market and continued consumer spending, along with our ability to handle additional volume, will help drive cargo to Los Angeles in the coming months,” stated Gene Seroka, executive director of Port of Los Angeles.

Seroka, accompanied by Anne Neuberger, deputy national security advisor for Cyber and Emerging Tech, addressed the Port’s media briefing. Neuberger, in her role as deputy assistant to President Biden, provides counsel on cybersecurity, digital innovation, and emerging technologies.

During the briefing, Neuberger discussed President Biden’s recent executive order aimed at strengthening cybersecurity measures at US ports.

In March 2024, loaded imports at 379,542 TEUs rose by 19% compared to the previous year. Loaded exports amounted to 144,718 TEUs, marking a notable 47% increase from the previous year. This month’s export performance was the Port’s strongest since January 2020, extending a streak of 10 consecutive months of year-over-year export growth.

The Californian port also handled 219,158 empty containers, reflecting a 7% increase over the figures from 2023.

Source video: Port of Los Angeles

Port of Rotterdam handles 3.3 million TEUs in 2024 Q1

For the first time in three years, the container segment of the Rotterdam port is experiencing a slight uptick in throughput volumes.

There’s been a 3.3% increase in tonnes moved, rising from 31.5 million tonnes to 32.5 million tonnes, and a 2% rise in TEUs, reaching 3.3 million TEUs in the first quarter of 2024 at the Dutch port.

The situation in the Red Sea resulted in a notable decline in ships (-24.5%) and volume from Asia (-13.7%) during January and February, attributed to delays and missed sailings. Initially, accommodating the altered sailing schedules required adjustments in the logistics chain.

The overall demand for freight remains largely unchanged, with the situation now stabilized. In March, there was a notable increase in the number of arriving ships (11.5%), and volumes from Asia rebounded. Positive results were also observed in other shipping regions, driven by a cautious economic recovery and destocking activities.

Moreover, in the first quarter of 2024, total throughput at the port of Rotterdam decreased by 1.4% compared to the corresponding period last year. Specifically, throughput amounted to 110.1 million tonnes, down from 111.7 million tonnes in the first quarter of 2023.

This decline is primarily attributed to reduced throughput of coal, crude oil, and oil products. However, there was an increase in throughput of iron ore & scrap and LNG. Additionally, container throughput showed a 3.3% increase during this period.

Furthermore, there’s been a significant surge (29%) in feeder traffic from Rotterdam to Mediterranean seaports. This increase is attributed to ships rerouting via the Cape of Good Hope, bypassing certain ports, and transporting cargo destined for the region via feeder vessels from Rotterdam to Mediterranean ports.

However, the total throughput of the breakbulk market segment, including Roll-on/Roll-off and other breakbulk, experienced a slight decline of 1.9% to 7.8 million tonnes. Specifically, Roll-on/Roll-off throughput decreased by 3.8% to 6.3 million tonnes compared to the first quarter of last year, mainly due to ongoing challenges in volumes to the UK. Conversely, other breakbulk saw a notable increase of 7.4% to 1.5 million tonnes.

Dry bulk throughput experienced a 4.5% decrease compared to the first quarter of 2023. Meanwhile, liquid bulk throughput saw a 3.1% decline, amounting to 52.6 million tonnes.

“The throughput figures show limited imports of raw materials and exports of finished products. This tells us that European industrial production is still suffering from high energy prices and low demand from the biggest declining sectors such as construction and the processing and automotive industries. From the growth in container throughput, we see the first signs that world trade is picking up. However, these tentative signs remain highly uncertain due to rising global tensions,” stated Boudewijn Siemons, CEO & Interim COO of the Port of Rotterdam Authority.

Source: Container News

TIPC upgrades container terminals in Kaohsiung

Container Terminal 7 of the port of Kaohsiung, which started operations in May 2023, is expected to increase the annual container handling capacity of the Taiwanese port by 6.5 million TEUs, according to Taiwan International Ports Corporation (TIPC), which is now focussed on the upgrade of two other box terminals.

TIPC has now shifted its attention to Port of Kaohsiung’s 3rd and 5th Container Terminals and adjacent container yard areas aiming to further enhance port competitiveness and realize sustainable growth goals.

TIPC noted that “with shipping companies commissioning increasingly larger container ships, streamlining hub and feeder port operations, and raising overall shipping capabilities, existing port infrastructures, from wharf water depths and support facilities to navigation channels, are increasingly inadequate for industry needs.”

Therefore, beyond constructing the new Container Terminal 7, TIPC has allocated an additional budget of NT$4.469 billion (around US$140 million) to improve and upgrade infrastructures at the port’s 3rd and 5th Container Terminals, which, once completed, will significantly increase the handling capacity and operational efficiencies.

At Container Terminal 3 Wharf No. 70, the water depth will be lowered from -13.5m to -15.2m, and 100 feet (30.48 metres) of new gantry crane track along with new dockside handling equipment will be installed. Additionally, at Container Terminal 5 Wharf Nos. 77~79, the water depth will be lowered from -14.5m to -17.0, and 120 feet (36.60 metres) of new gantry crane track along with new dockside handling equipment will be installed.

Furthermore, in line with ongoing green-port commitments, new onshore power and water supply systems are being installed to move TIPC ports closer to international zero-carbon targets.

The works on the two container terminals began on 21 February 2024 and the project is scheduled to be completed by summer 2027.

TIPC has decided to split the project into several phases in order not to affect the normal operations of the port.

Moreover, TIPC will jointly invest with shipping companies in the Container Terminal 5 improvement work, with TIPC handling wharf improvements and companies upgrading container yard facilities. Once completed, companies may invest in and install state-of-the-art container handling equipment and shipside gantry cranes to handle the world’s largest-class container carriers.

In addition, the deepening of water depths in and around these terminals will improve safe access to modern container ships, increase the advantage to shipping operators, and raise port operating efficiencies, according to the TIPC statement.

Source: Container News

Port of Hong Kong faces severe connectivity loss

Recent service networks released by the container shipping alliances reveal a noticeable trend: Major shipping companies are rapidly scaling back their presence in Hong Kong along East-West shipping routes.

Gemini’s latest network overview reveals no scheduled direct deep-sea calls to Hong Kong. Likewise, the Ocean Alliance’s 2024 network update shows a significant reduction in direct port calls, plummeting from 11 to just six. Additionally, in THE Alliance’s newly published 2025 Transpacific network overview, Hong Kong is notably absent from their Pacific South West and Pacific North West services, leaving only one Asia-US East Coast service remaining.

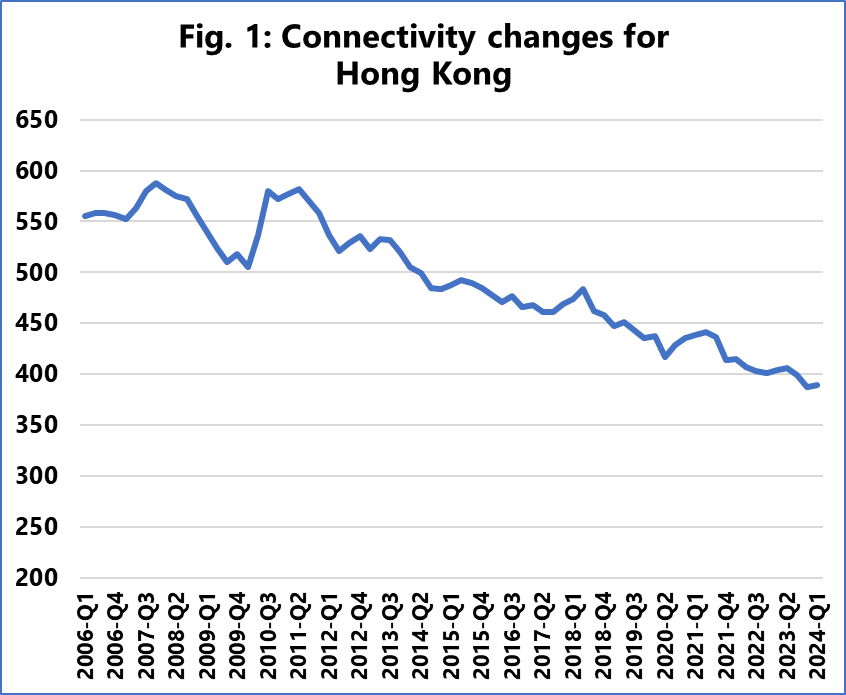

The latest data from the United Nations Conference on Trade and Development (UNCTAD) on the Liner Shipping Connectivity Index (LSCI) also underscores a continual decline in connectivity for Hong Kong over the past decade, as depicted in Figure 1. The LSCI for Hong Kong hit its lowest point of 388 in 2023-Q4, with a marginal uptick to 390 in 2024-Q1. Despite slight fluctuations, the overarching pattern indicates a consistent and sharp decline.

“While this does not bode well for the Port of Hong Kong, it should also be seen as a sign that an element of network consolidation is afoot, especially as it relates to transshipment hubs,” said Alan Murphy, CEO of Sea-Intelligence, a Danish maritime data analysis firm.

He pointed out, “Analysis of network design and network efficiency will show that fewer, but larger, hubs are economically more efficient. Hong Kong appears to be the first major ‘victim’ of this. But as the new alliance constellations improve their networks in the coming years, more ports could likely risk the same fate as Hong Kong.”

Source: Container News

MSC tops reefer rankings too

MSC has developed the largest capacity for refrigerated containers, as the Swiss-Italian liner giant strengthens its status as the largest liner operator.

Alphaliner’s report noted that MSC’s fleet has grown nearly 20% over the past year, and its 815 ships have 583,700 reefer plugs installed, representing an increase of almost 18%.

Only Ocean Network Express (ONE) recorded a bigger growth in the number of reefer plugs, at approximately 23%. The pan-Japanese carrier grew its overall fleet by 17.5%.

Meanwhile, South Korean flagship carrier HMM is the only liner operator which reduced its reefer capacity, which dipped by just over 1%, as it reduced its overall fleet by over 2% after redelivering some chartered ships.

Not surprisingly, the ranking of the top 10 carriers by reefer plugs is generally tied to the ranking by total fleet capacity. The one exception is the 10th-ranked ZIM Line, which is the eighth-largest in terms of reefer plugs. The Israeli carrier can deploy over 22% of its fleet to carry reefers.

Alphaliner’s reefer plug count confirms that European carriers have a larger proportion of their total capacity accessible for reefer cargo. The percentage of slots available for plugged-in reefer boxes ranges from 20% for MSC to 23% for Maersk Line, with CMA CGM (22.5%) and Hapag-Lloyd (21.2%) in between. This compares to 15.7%-17.5% for their Asian counterparts, with ONE at the top end and HMM at the low end.

Source: Container News

ONE announces updated Transpacific network for 2025

Ocean Network Express (ONE) has announced its upgraded Transpacific service network, which will commence in February 2025.

The carrier’s Transpacific product comprises 16 primary services, each tailored to deliver efficient and reliable shipping solutions.

ONE’s Transpacific service network for 2025:

Asia – US West Coast South

FP1 (Far East – Pacific 1):

From Europe, Singapore (Singapore), Kobe (Japan), Nagoya (Japan), Tokyo (Japan), Los Angeles/Long Beach (United States), Oakland (United States), Tokyo (Japan), Shimizu (Japan), Kobe (Japan), Nagoya (Japan), Tokyo (Japan), Singapore (Singapore), to Europe

PS3 (Pacific South 3):

Nhava Sheva (India), Pipavav (India), Colombo (Sri Lanka), Port Kelang (Malaysia), Singapore (Singapore), Cai Mep (Vietnam), Haiphong (Vietnam), Yantian (China), Los Angeles/Long Beach (United States), Oakland (United States), Tokyo (Japan), Pusan (South Korea), Shanghai (China), Ningbo (China), Shekou (China), Singapore (Singapore), Port Kelang (Malaysia), Nhava Sheva (India)

PS4 (Pacific South 4):

Xiamen (China), Yantian (China), Kaohsiung (Taiwan), Keelung (Taiwan), Los Angeles/Long Beach (United States), Oakland (United States), Keelung (Taiwan), Kaohsiung (Taiwan), Xiamen (China)

PS6 (Pacific South 6):

Qingdao (China), Ningbo (China), Los Angeles/Long Beach (United States), Oakland (United States), Kobe (Japan), Qingdao (China)

PS7 (Pacific South 7):

Singapore (Singapore), Laem Chabang (Thailand), Cai Mep (Vietnam), Shanghai (China), Los Angeles/Long Beach (United States), Oakland (United States), Shanghai (China), Singapore (Singapore)

PS8 (Pacific South 8):

Shanghai (China), Ningbo (China), Kwangyang (South Korea), Pusan (South Korea), Los Angeles/Long Beach (United States), Oakland (United States), Pusan (South Korea), Kwangyang (South Korea), Incheon (South Korea), Shanghai (China)

AP1 (Asia Pacific 1):

Haiphong (Vietnam), Cai Mep (Vietnam), Shekou (China), Xiamen (China), Taipei (Taiwan), Ningbo (China), Shanghai (China) (Yangshan), Los Angeles/Long Beach (United States), Oakland (United States), Shekou (China), Haiphong (Vietnam)

AHX (Asia Hawaii Express):

Pusan (South Korea), Yokohama (Japan), Honolulu (United States), Pusan (South Korea)

Asia – US West Coast North

PN1 (Pacific North 1):

Xiamen (China), Kaohsiung (Taiwan), Ningbo (China), Nagoya (Japan), Tokyo (Japan), Tacoma (United States), Vancouver (Canada), Tokyo (Japan), Kobe (Japan), Nagoya (Japan), Xiamen (China)

PN2 (Pacific North 2):

Singapore (Singapore), Laem Chabang (Thailand), Cai Mep (Vietnam), Haiphong (Vietnam), Yantian (China), Vancouver (Canada), Tacoma (United States), Tokyo (Japan), Kobe (Japan), Shanghai (China), Singapore (Singapore)

PN3 (Pacific North 3):

Qingdao (China), Ningbo (China), Shanghai (China), Pusan (South Korea), Vancouver (Canada), Tacoma (United States), Pusan (South Korea), Qingdao (China)

Asia – US East Coast

EC1 (US East Coast 1):

Kaohsiung (Taiwan), Yantian (China), Shanghai (China), Ningbo (China), Pusan (South Korea), Panama, New York (United States), Norfolk (United States), Savannah (United States), Panama, Balboa (Panama), Kaohsiung (Taiwan)

EC2 (US East Coast 2):

Xiamen (China), Yantian (China), Ningbo (China), Shanghai (China), Pusan (South Korea), Panama, Manzanillo-PA (Panama), Savannah (United States), Charleston (United States), Wilmington (United States), Norfolk (United States), Manzanillo-PA (Panama), Panama, Pusan (South Korea), Xiamen (China)

EC5 (US East Coast 5):

Laem Chabang (Thailand), Cai Mep (Vietnam), Singapore (Singapore), Colombo (Sri Lanka), Suez, Halifax (Canada), New York (United States), Savannah (United States, Jacksonville (United States), Charleston (United States), Norfolk (United States), New York (United States), Halifax (Canada), Suez, Singapore (Singapore), Laem Chabang (Thailand)

EC6 (US East Coast 6):

Kaohsiung (Taiwan), Hong Kong (China), Yantian (China), Ningbo (China), Shanghai (China), Pusan (South Korea), Panama, Houston (United States), Mobile (United States), Panama, Rodman (Panama), Kaohsiung (Taiwan)

WIN (West India North America):

Bin Qasim (Pakistan), Hazira (India), Nhava Sheva (India), Mundra (India), Damietta (Egypt), Algeciras (Spain), New York (United States), Savannah (United States), Jacksonville (United States), Charleston (United States), Norfolk (United States), Damietta (Egypt), Jeddah (Saudi Arabia), Bin Qasim (Pakistan)

Source: Container News

ONE targets market share with 2030 strategy

Singapore-headquartered Ocean Network Express (ONE) is looking to leapfrog its THE Alliance partner Hapag-Lloyd as the fifth largest carrier with a sustained fleet growth of around 10% per year to the end of this decade.

The company said in its recently released ONE 2030 strategy that it will invest US$25 billion in its fleet to add close to 1.2 million TEUs in capacity, taking its standing fleet to 3 million TEUs.

Stefan Verberckmoes, senior analyst at Alphaliner said, “One of the main reasons explaining the strategy is that they are aware that a carrier needs economies of scale to be profitable to finance decarbonisation.”

However, former research analyst Mark McVicar believes, “The move is an attempt to gain market share, but in order for the market to remain buoyant it relies on the assumption that others will cede market share.”

Fleet growth for the Singapore-based line will increase over the six-year period from around 4%, which is below the level of market growth, to 10% annually, higher than the projected market growth to the end of the decade. Accountants PWC projects annual global GDP growth of around 3-3.5%.

“ONE should realise an annual fleet growth of around 10% until 2030 to reach its goals. That’s indeed a very ambitious plan in a market where moderate growth and overcapacity is expected,” added Verberckmoes.

The ONE 2030 plan includes delivering sustainable solutions for its vessels to meet new regulations and the acquisition of terminals in key regions of the world.

In addition, the company will identify key growth regions, with increasing cargo flows, strengthen its customer service support, meeting customers’ requirements for digitalised services.

Moreover, ONE expects to move into areas within the logistics “value chain”. Dynamar analyst Darron Wadey said the company cites its moves for Atlas and the terminal operations of its Japanese shareholders, MOL, NYK and K Line.

Wadey also points out that “No specific mention of logistics has been made,” and that the company has allocated some US$10 billion to develop these what ONE calls “adjacent” businesses.

He added, “Should ONE make a definitive move into container logistics, this could be facilitated by its shareholders in a similar way to how it entered into container terminal investments, namely taking over stakes held by its parents.

“Buying into its parent’s already well-established and extensive logistics presences would make sense. For starters, ONE would not be burdened by expensive start up from scratch costs. It would also avoid creating a competitor to its shareholders’ existing activities.”

Transforming its fleet and services will mean that the carrier will target US$3.8 billion profits by the end of the implementation period, an aim that McVicar described as “reasonable”.

According to ONE, the initial two years of ONE 2030 are the years during which the industry may be affected by newbuildings. However, due to geographic and political factors such as the ongoing Red Sea crisis, it is rather difficult to predict the profit level in a logical manner, said the company.

Nevertheless, ONE predicts that after these two years, profits will be boosted by a better supply and demand balance and that its returns will also improve as a result of the early benefits of its strategy.

Source: Container News

APM Terminals Moín handles over 6 million TEUs in five years of operation

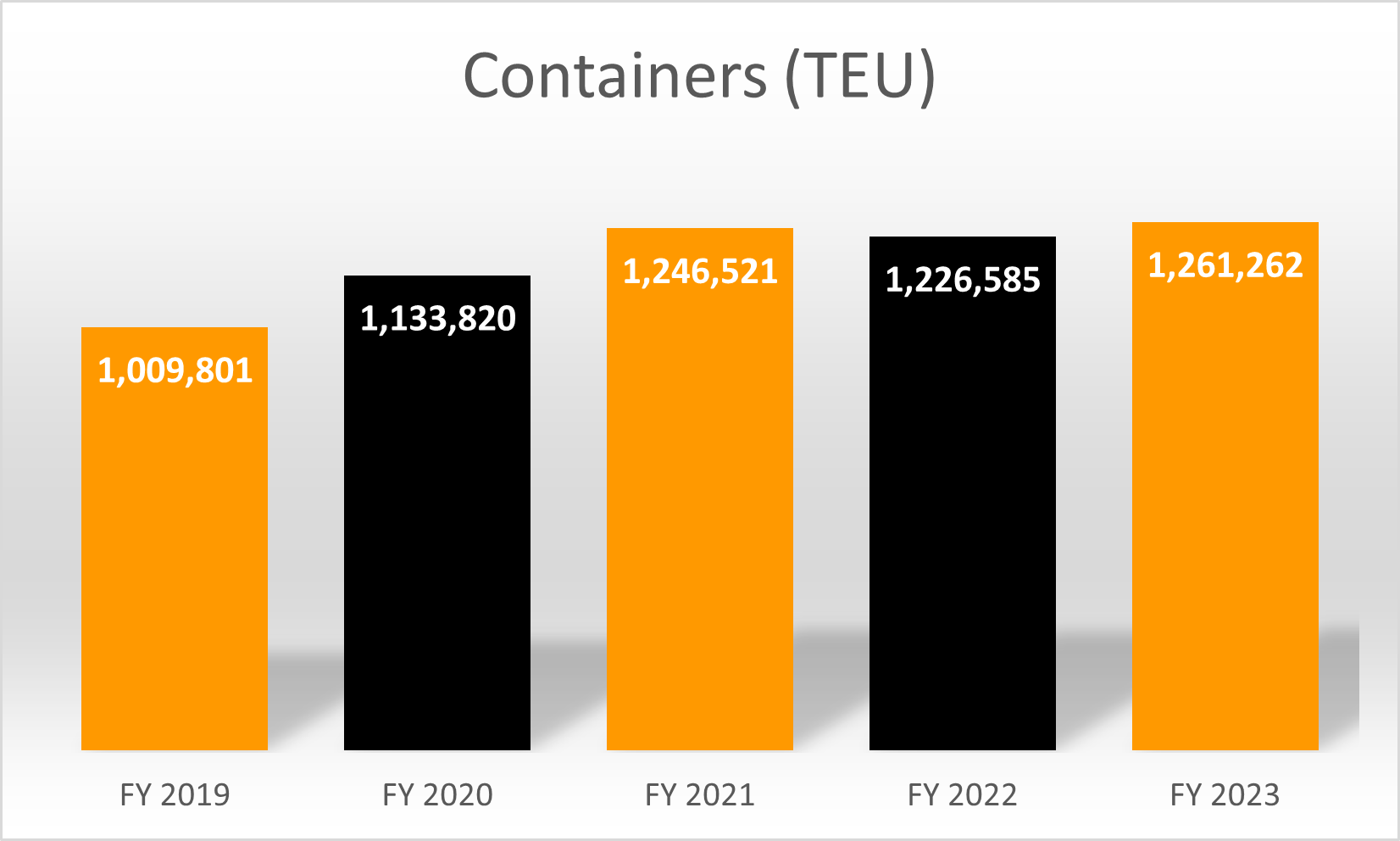

In just over five years since the launch of its operations in 2018, APM Terminals Moín (TCM) has handled over 6 million TEUs.

Throughout this period, container volumes have shown growth, increasing from 1 million TEUs in 2019 to 1.3 million TEUs in 2023. Moreover, the average monthly number of vessels calling at the terminal has risen from 12 in 2018 to over 89 in 2023, marking a threefold increase compared to other ports in the region.

Approximately 80% to 85% of the Costa Rican terminal operations focus on the efficient and timely handling of export commodities, including bananas, pineapples, coffee, tubers, and melons. These exports not only drive economic activity but also have a positive impact on job creation, benefiting thousands of individuals employed directly and through subcontractors.

“We have focused on lifting the standard of innovation, and efficiency and providing a quality service for our customers, the development and growth of our partners and the country. The time taken to release cargo, less than 4 days, has been recognized by the Logistics and Customs Commission of the Costa Rican Chamber of Commerce. Now, we are in a solid position to continue being one of the world’s leading terminals and lift the standard of efficiency and reliability even further,” commented José Rueda, general manager of APM Terminals Moín.

Furthermore, the terminal employs advanced technologies for efficiency, including automated gates with OCR systems for container ID verification and appointment scheduling to manage gate traffic. Additionally, OCR technology on ship-to-shore cranes ensures accurate container handling, while high-resolution cameras capture container conditions for visual documentation.

“APM Terminals is a company at the forefront of technology to not only strengthen the security and efficiency of operations but also to significantly improve our customers’ experience. We are committed to continue innovating to keep Costa Rica at the forefront of the best practices in the port industry, contributing to the sustainable development of the global import and export logistics chain,” explained Mehdi Ben Mouloud, deputy director general and chief operating Officer of TCM.

Source: Container News

Innovative Ways Business Owners Use Shipping Containers

Shipping containers offer creative solutions for various business needs.

Beyond their traditional role in transportation, can serve a variety of purposes that help entrepreneurs, small business owners, and startups cut back on operational expenses.

In this article, we discuss the many unconventional and ingenious applications of shipping containers, from self-storage facilities and alternative office spaces to coffee shops and nail salons. Discover how business owners worldwide are leveraging the durability, portability, and affordability of shipping containers to unlock new opportunities and enhance their operations.

Keep reading to learn all about the boundless possibilities of using shipping containers for business.

8 Shipping Container Business Ideas

In recent years, shipping containers have gained popularity as a cost-effective alternative to traditional brick-and-mortar business buildings. Their modular design, durability, and mobility make them ideal for creating unique and creative spaces that meet diverse business needs.

Let’s take a look at eight popular business uses for shipping containers:

1. Self Storage Shipping Container

Shipping containers provide an efficient and cost-effective solution for self-storage facilities.

These durable, steel shipping containers ensure the safety and security of stored items, while their modular design allows for scalability to accommodate varying storage needs. Additionally, shipping containers can be customized with features such as climate control, shelving, and security systems to enhance functionality and meet specific requirements.

For businesses in the storage industry, investing in shipping container self-storage facilities offers a lucrative opportunity to capitalize on the growing demand for flexible storage solutions.

2. Container Coffee Shop

Transforming a shipping container into a coffee shop offers an eye-catching venue for serving up delicious brews. With minimal modifications, such as installing windows, doors, and counters, a shipping container can be converted into a cozy and inviting coffee shop.

These compact cafes are perfect for setting up in urban areas, parks, or event venues, providing a trendy and convenient spot for customers to grab their morning coffee or enjoy a leisurely break.

Container coffee shops also offer flexibility, allowing owners to relocate their business easily to capitalize on different foot traffic opportunities.

3. Office Space Shipping Container

Shipping containers are increasingly being used as office spaces due to their versatility and quick deployment capabilities. With the addition of insulation, windows, doors, and electrical wiring, a shipping container can become a comfortable and functional workspace.

Container offices are ideal for startups, remote workers, or businesses looking for affordable and customizable office solutions. These unique office spaces can be set up individually or clustered together to create larger workspaces, making them suitable for coworking environments or temporary office expansions during peak business seasons.

Andrew, the owner of Venango Awnings and GT Watts Awnings says “I often use shipping containers as on-site storage and a make-shift office for large awning projects”

4. Shipping Container Yoga Studio

For fitness enthusiasts and yoga practitioners, a shipping container can serve as a tranquil and intimate space for yoga classes and wellness workshops.

With the addition of flooring, insulation, and ventilation systems, you can convert a shipping container into a serene yoga studio that offers a peaceful retreat from the hustle and bustle of everyday life. These container studios are portable and can be placed in scenic locations like parks, beaches, or nature reserves, providing a unique setting for yoga enthusiasts to practice mindfulness and connect with nature.

5. Shipping Container Art Gallery

Shipping containers offer a dynamic and customizable space for showcasing artwork and exhibitions.

The sturdy structure of shipping containers makes them a great foundation for modern and sleek galleries that provide a unique backdrop for artistic expression. Container art galleries are versatile and can be easily relocated from urban art districts to outdoor festivals and cultural events.

These innovative galleries offer artists and curators an opportunity to engage with new audiences and create immersive art experiences that captivate and inspire visitors.

6. Recording Studio Shipping Container

For musicians and audio professionals, a shipping container can be converted into a state-of-the-art recording studio that offers a professional and acoustically optimized environment.

With soundproofing, insulation, and interior finishes, a shipping container can provide a controlled and comfortable space for recording music, podcasts, or audio content.

Plus, container recording studios are portable and can be set up in remote locations or urban settings, offering flexibility and convenience for artists on the go. These compact studios also offer cost-effective solutions for independent musicians or small production companies looking to establish a professional recording space.

7. Shipping Container Nail Salon

Transforming a shipping container into a nail salon offers a trendy and modern space for offering manicures, pedicures, and nail art services.

With the addition of plumbing, electrical wiring, and interior finishes, you can convert shipping into stylish and functional salons that provide a comfortable and hygienic environment for clients.

Additionally, you can set up your container nail salon in different locations based on your target clientele, such as shopping malls, markets, or outdoor events. This provides convenience and accessibility for customers, while enabling you to position your business as strategically as possible.

These compact salons offer you a cost-effective and customizable option for launching a nail salon.

8. Container Hotel

Shipping containers have revolutionized the hospitality industry by offering an innovative and sustainable alternative to traditional hotels. Container hotels — constructed from repurposed shipping containers — mark the next step in hotel innovation, offering unique and eco-friendly accommodations for travelers.

With the addition of insulation, windows, doors, and interior finishes, shipping containers can be transformed into stylish and comfortable hotel rooms that offer all the amenities of a traditional hotel.

These innovative hotels appeal to eco-conscious travelers seeking environmentally friendly lodging options that combine comfort, style, and sustainability.

Final Thoughts

The versatility and adaptability of shipping containers make them invaluable assets for a wide range of business ventures. From self-storage facilities to creative retail concepts and hospitality spaces, shipping containers offer endless possibilities for entrepreneurs looking to innovate and stand out.

By harnessing the transformative power of shipping container architecture, business owners can create unique and memorable experiences for their customers while maximizing efficiency, flexibility, and sustainability. Plus, investing in shipping containers is often much more cost-effective than purchasing full-blown commercial buildings or properties, making it easier to get new businesses off the ground.

Discover the possibilities of shipping container business spaces today.

Source: Container News