Container volume at China ports rose by 4.8% in the January-August period, compared to the same months last year.

The container throughput of Chinese ports was 203.7 million TEUs, while for the same period, the cargo volume of major Chinese ports was 11.1 billion tons, translating to an 8.4% rise year-on-year.

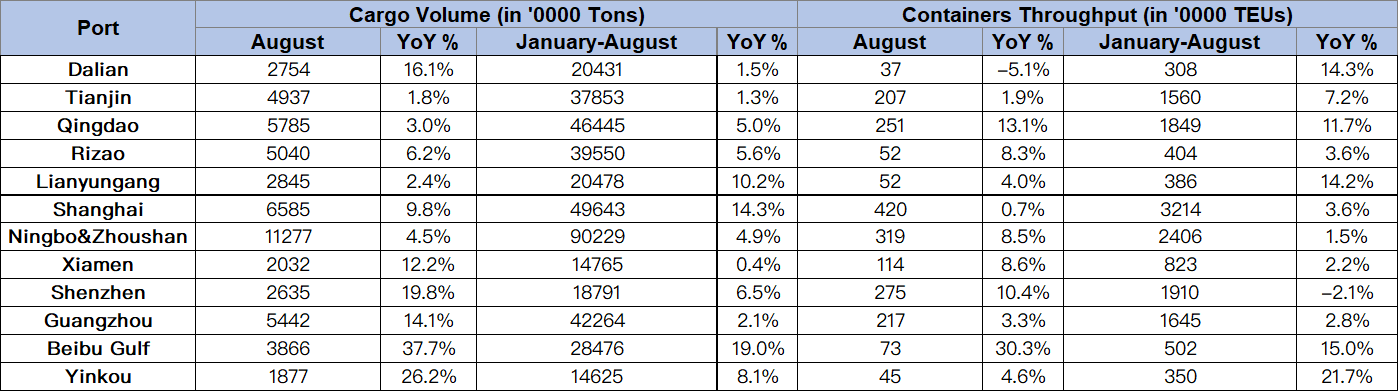

The following table mentions cargo and container throughput data from China’s twelve major ports.

As seen in the table, the port of Shanghai has maintained its dominance, being the busiest container port in the country with 32 million TEUs.

The port of Ningbo & Zhoushan is the second busiest box port in China with 24 million TEUs and in the third place, we find the port of Shenzhen with 19 million TEUs.

At the same time, the port of Shenzhen was the only one from the list that reported a year-on-year decline in its container volumes from January to August with its throughout falling by 2.1%.

Meanwhile, the largest percentage growths were registered at the smaller ports of Yinkou, Beibu Gulf, Dalian and Lianyungang. Yinkou reported year-on-year box growth of 21.7%, Beibu Gulf achieved a 15% container increase, Dalian saw its TEU volumes rise by 14.3% and Lianyungang increased its throughput by 14.2%.

Source: Container News

Congestion around the world’s busiest container port is expected to intensify as Shanghai will be locked down in two stages for a Covid-19 mass testing exercise.

Congestion around the world’s busiest container port is expected to intensify as Shanghai will be locked down in two stages for a Covid-19 mass testing exercise.