The Maritime and Port Authority of Singapore (MPA), the Port of Rotterdam Authority (PoR), and 20 partners in the Green & Digital Shipping Corridor are collaborating to cut international shipping emissions by 20%-30% until 2030.

The agreement was made in the third Green Corridor workshop, which was held in Rotterdam, the Netherlands this week.

The Green & Digital Shipping Corridor was formed in August 2022 to bring together supply chain partners to achieve zero and near-zero emissions shipping on the Rotterdam-Singapore route, with the ultimate goal of reaching net-zero emissions by 2050.

The corridor has received strong support from global value-chain partners such as shipping lines, port authorities and operators, fuel suppliers, fuel coalitions and organisations, banks, premier universities of higher learning, and knowledge partners during the last year.

Moreover, the corridor will continue to intensify efforts to meet the International Maritime Organization’s (IMO) increased goal under the 2023 IMO Strategy on reducing GHG Emissions from Ships.

This will be accomplished by the development and use of zero and near-zero emission fuels in large container vessels (at least 8,000 TEUs) deployed along the 15,000 km route, as well as through a mix of operational and digital efficiency.

According to a statement, a modelling study led by the Mærsk Mc-Kinney Møller Center for Zero-Carbon Shipping, one of the project’s corridor partners, and supported by the ports investigated multiple alternative fuels across a range of zero and near-zero emission pathways, such as synthetic and bio-variants of methanol, ammonia, and LNG.

Aside from the study, hydrogen is another possible fuel pathway that should be investigated. Efforts are being made to aggregate demand and supply in order to close the cost gap in the adoption of sustainable fuels.

Working groups have been formed to investigate the deployment of all of these fuels in the trade lane, covering topics such as fuel demand and supply, standards, safety procedures, financing, and legislation. This week, the corridor partners met in Rotterdam to determine the next measures for various fuel pathways.

Source: Container News

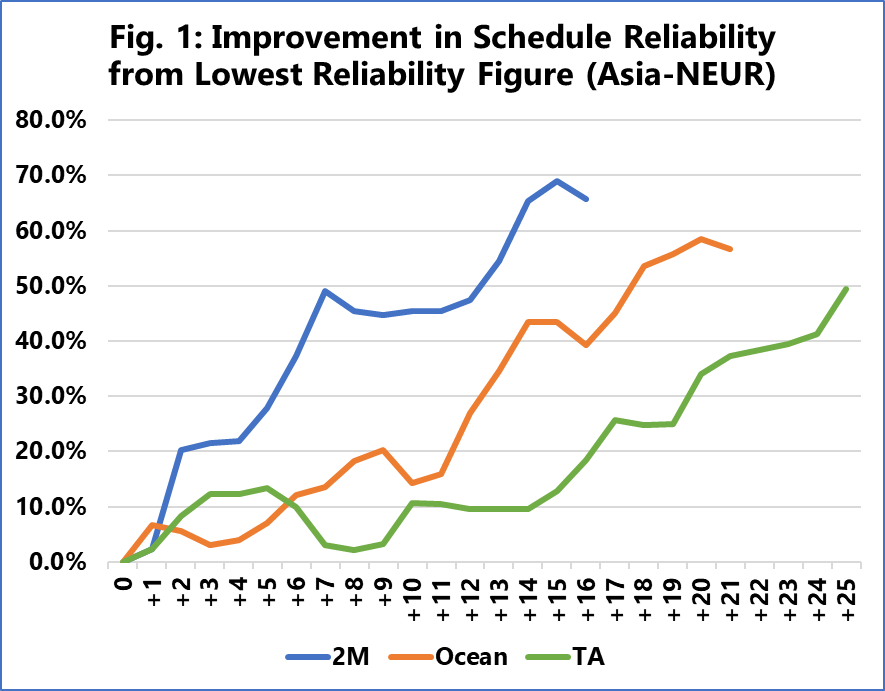

To gauge which of the three container carrier alliances recorded the fastest post-pandemic recovery in schedule reliability, Danish maritime data analysis company Sea-Intelligence pegged their lowest recorded schedule reliability during the pandemic as month “0” and then looked at the change from that baseline in the next months.

To gauge which of the three container carrier alliances recorded the fastest post-pandemic recovery in schedule reliability, Danish maritime data analysis company Sea-Intelligence pegged their lowest recorded schedule reliability during the pandemic as month “0” and then looked at the change from that baseline in the next months.