Tianjin Port Group and Guangzhou Port Group have inked an agreement to commence a direct route between the ports, to cut down on transhipments.

This is part of Tianjin Port’s FAST (Freight, Accuracy, Saving, Team) scheme to expedite container shipments.

This is part of Tianjin Port’s FAST (Freight, Accuracy, Saving, Team) scheme to expedite container shipments.

Chinese liner operators, such as COSCO Shipping Lines’ intra-Asia arm Shanghai Pan Asia Shipping, Zhonggu Logistics and Antong Holdings, as well as local non-vessel owning common carrier Trawind Shipping, were also signatories to the agreement.

Tianjin Port Group chairman, Chu Bin said that in recent years Tianjin and Guangzhou have become the busiest ports in northern and southern China, respectively, handling 30% of intra-country shipments. In 2020, 1.38 million TEU were moved between the two ports.

Compared with the traditional shipping model, the core advantages of FAST are speediness, schedule reliability, high efficiency, and a reduction in sailing time by more than 10%, according to Chu, who noted, “Tianjin and Guangzhou ports are important logistics nodes of China’s north-south transportation corridor.”

Source: Container News

New container prices still rising

New container prices still rising

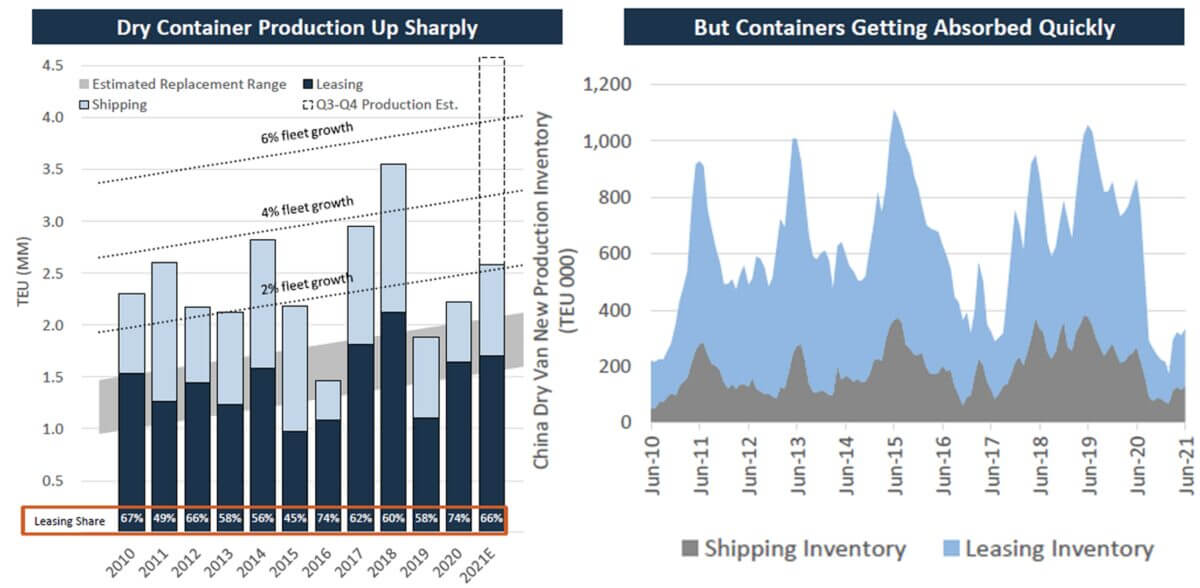

Numbers from Drewry on global production of all container types show the same trend. As of May, Drewry reported that 2.66 million TEUs overall had been produced year to date, with factories on track to build at least 5 million TEUs this year. That would bring this year’s tally at least 18% higher than the all-time high in 2018.

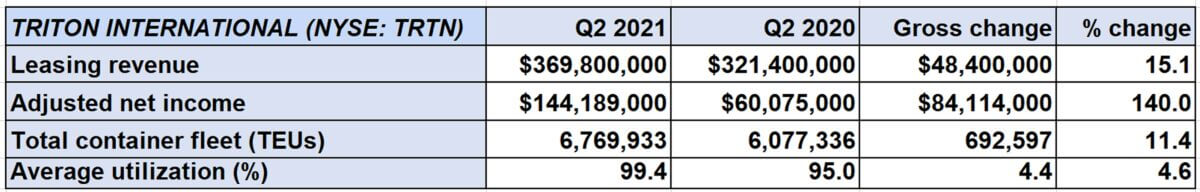

Numbers from Drewry on global production of all container types show the same trend. As of May, Drewry reported that 2.66 million TEUs overall had been produced year to date, with factories on track to build at least 5 million TEUs this year. That would bring this year’s tally at least 18% higher than the all-time high in 2018. Triton is using the current demand boom to lock in revenues via “very long-duration, high-return leases,” said Sondey. The average lease duration for containers ordered in 2021 is 13 years, far above the historical norm of five to seven years.

Triton is using the current demand boom to lock in revenues via “very long-duration, high-return leases,” said Sondey. The average lease duration for containers ordered in 2021 is 13 years, far above the historical norm of five to seven years.

The issues at the Bayport and Barbours Cut terminals were first reported Tuesday, just before the gates were set to open at about 7 a.m.

The issues at the Bayport and Barbours Cut terminals were first reported Tuesday, just before the gates were set to open at about 7 a.m.